Most of us want to learn how to diversify investments so we can reduce investment risk – but it may be one of the most misunderstood of investment principles. Too many think it’s about simply selecting the right pie chart.

I’ve even seen tv stock gurus tell you that owning three stocks in different industries passes forinvestment diversification, implying that risk is being reduced. I don’t think so; it’s just compounding investment concentration.

Believe it or not, you can’t possibly diversify-away market risk. Think about it; you could own every single stock contained in the S&P 500 Index and all you would have done is duplicate the market’s risk.

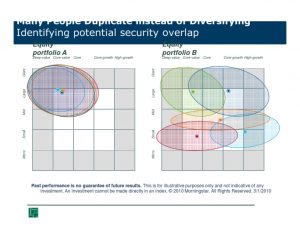

I’ve also seen investors buy multiple mutual funds in an attempt to diversify; but, since everything they bought had to be “quality”, all they did was duplicate their holdings (portfolio A) instead of diversifying them (portfolio B) across multiple investment styles (growth/value, large/small, etc.).

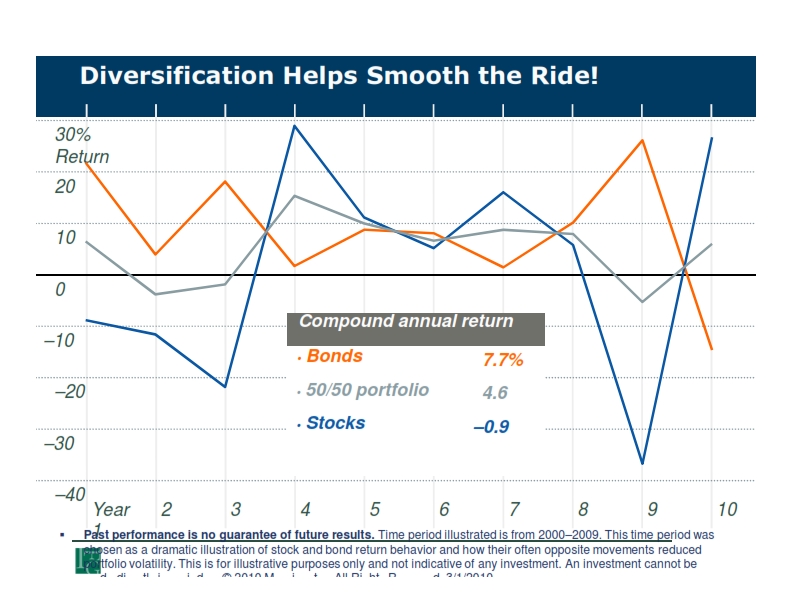

Diversification, done properly, can smooth things out, as this simple example shows.

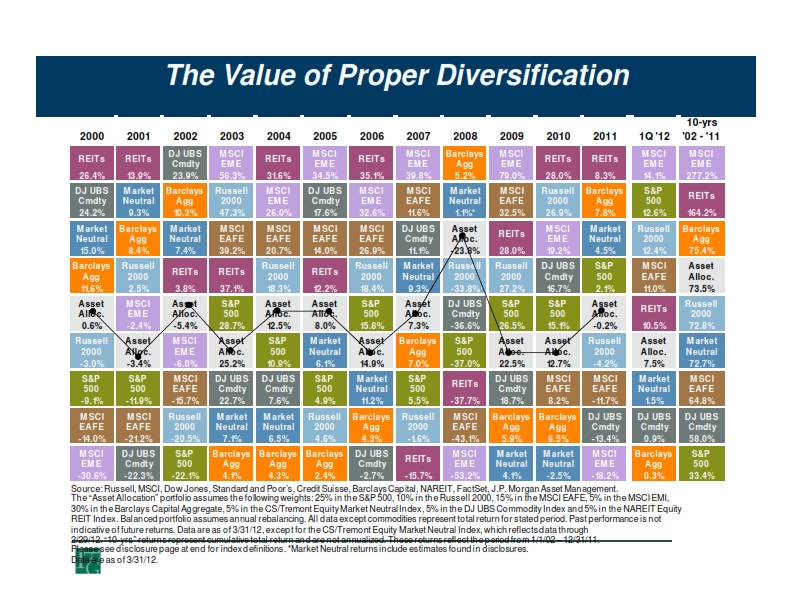

But, what stocks? Which bonds? Is buying a few enough? The answer, of course, is “it depends”; but, it’s worth noting that there are five basic asset classes (stocks, bonds, real estate, commodities, and cash) and within each there are multiple sectors. It’s also virtually impossible to know which will outperform all others in any given year. Yet, diversification among them can smooth the ride!

But, what stocks? Which bonds? Is buying a few enough? The answer, of course, is “it depends”; but, it’s worth noting that there are five basic asset classes (stocks, bonds, real estate, commodities, and cash) and within each there are multiple sectors. It’s also virtually impossible to know which will outperform all others in any given year. Yet, diversification among them can smooth the ride!

I’ve been telling clients for more than two decades now, “We’re not diversifying money. We’re diversifying risk; we just do it with money.”

I’ve been telling clients for more than two decades now, “We’re not diversifying money. We’re diversifying risk; we just do it with money.”

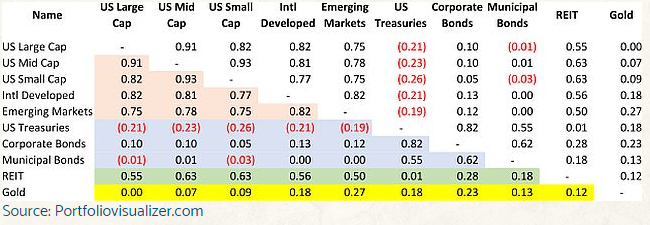

So, how do we diversify risk? It’s all about something called correlation.

You can think of correlation as pistons in an engine: They all go up and down, but not necessarily at the same time. Their going up and down is what propels the machine, but you wouldn’t want your money on any one piston. If the engine were to stop, you’d have a 50/50 chance of being up or down! But, if your money was spread over all the cylinders, you’d still have a stable overall value regardless of when the engine shut down.

It doesn’t really work all that clearly in the real world of investing, of course; but the theory is no less valid. Here’s a chart the relative correlations among a number of classes and styles.

Correlations don’t remain the same, even from day-to-day; so, they’re not in stone – they just give us a historical look at their relative movements, but the numbers will be different depending on the time-frames chosen.

Diversification is all about correlation reduction in portfolios. I created a report on all this a while back calledUnderstanding the Diversification Puzzle. You might find it helpful and you can get it here.

Diversification is all about correlation reduction in portfolios. I created a report on all this a while back calledUnderstanding the Diversification Puzzle. You might find it helpful and you can get it here.

Enjoy!

Jim

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.