Generational planning didn’t seem important for old age financial security in my grandparent’s day. They were living at a time when Social Security was passed and designed to last for a lifetime beginning at age 65. Of course, life expectancy back then was around age 68! Who needed to worry about generational issues? Longevity wasn’t a risk.

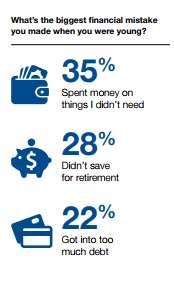

My generation—the baby boomerss—became the first to experience the ‘sandwich’ effect: Taking care of aging parents and children at the same time. And, as that was unfolding, people were beginning to realize they were living longer, too!

The cultural quicksand began to materialize, but few have recognized it. It’s like glaucoma: You don’t see it coming; but, all of a sudden, it’s there. It’s silence. In a recent online survey (cited below), over half of GenX respondents and 60% of baby boomers indicated they’ve never had a conversation about planning for retirement or financial security in their old age, yet their fears were the same.

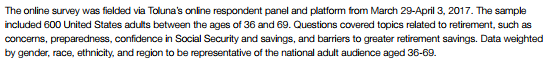

The reasons tend to tell is why. They’re repeating the same mistakes their parents made.

The reasons tend to tell is why. They’re repeating the same mistakes their parents made.

Why do we study history? Because we know human nature doesn’t change—it hasn’t changed for thousands of years. Studying history allows us to learn the mistakes human nature, unencumbered by knowledge, tends to make. But, knowledge helps us prevent a repetition!

When parents and children don’t talk about finances, guess what…

Why do they feel they’re not making enough money? Why do they have too many other expenses and are paying off debt? The answer is simple.

They’re repeating mistakes. But, the GenX group seems to be making more of them. Are the boomers not talking to their kids? Are their kids not involved in their parent’s own planning? Maybe they should be.

As parents are living longer—longevity risk– they run a very real risk of needing long-term care. If ever there was a threat to old age financial security, this may be it; yet, relatively few address that issue usually because of cost or for fear of losing all that money paid in premiums if they don’t use it. However if they do need it, and the kids end up having to pay some or all of the ultimate cost for that and their parents’ support, it also could eat-up their inheritance!

As parents are living longer—longevity risk– they run a very real risk of needing long-term care. If ever there was a threat to old age financial security, this may be it; yet, relatively few address that issue usually because of cost or for fear of losing all that money paid in premiums if they don’t use it. However if they do need it, and the kids end up having to pay some or all of the ultimate cost for that and their parents’ support, it also could eat-up their inheritance!

What we don’t know can cause financial hurt. Perhaps they don’t know that a professionally-designed life insurance policy might provide tax-free money that could be used to cover long-term care if needed and yet preserves cash if it isn’t—and still maintain the children’s inheritance! It’s a financial ‘Swiss Army Knife” type tool that can solve a lot of issues at once.

Unfortunately, few people take the time to have a generational financial planning session either on their own or – maybe better—facilitated with a family financial advisor acting as a guide and facilitator. Some advance planning can make a big difference. Here’s an example:

Real Life Case History (Names changed)

Fred and Wilma never discussed their finances with Pebbles or Bam Bam. As Fred and Wilma grew into their 90s, it became evident they could no longer live on their own. Fred was diagnosed with a terminal disease and Wilma, at 90, was diagnosed with Alzheimer’s. They could no longer function and it was now Pebbles’ and Bam Bam’s turn to take care of their parents. Fred lived for eight more months, but Wilma continued living for nine more years. Despite the fact they did have some retirement savings, it was no where near enough to cover the more than $600,000 in costs that were incurred by Pebbles and Bam Bam during that 9-year period.

Had Fred and Wilma taken the right steps sooner, those costs threatening the old age financial security of Pebbles and Bam Bam might have been covered, or—at the very least—Pebbles and Bam Bam would have been reimbursed, protecting their inheritance … and all of the money might have been provided tax-free! Unfortunately, their attitudes about various financial solutions available to them were colored by what they’ve heard from parents, friends, and even entertainment media, including television gurus selling DVDs. Not surprising. Some people even get their medical advice that way.

Old strategies simply don’t address today’s longevity and ageing issues. Different strategies are required. How can it be possible to make sure the parents have a lifetime of inflation-adjusted income and still provide an inheritance for the kids?

You might enjoy viewing this educational 20-minute video that shows one strategy that likely makes sense for many people. While the tools used to implement it might vary, it’s still worth a view. So, grab some coffee and see for yourself.

You might enjoy viewing this educational 20-minute video that shows one strategy that likely makes sense for many people. While the tools used to implement it might vary, it’s still worth a view. So, grab some coffee and see for yourself.

If you haven’t had a generational meeting with your family financial advisor, maybe it’s time you did. Like Mark Cuban’s dad once told him: This is as young as you’re ever going to be.

If you would like help, of course, we can always visit by phone.

Enjoy!

Jim

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.