The late Don Butler, a legendary international management consultant and a mentor once said, “Funny how we never have time to do it right; but, we always find time to do it over.” You’ve probably spent your entire career laying the groundwork for a stress-free life; but, you probably won’t have time to do it over. It makes sense to hire a guide – someone who’s ‘made the trip’ before – many times. I’d like to help.

Jim Lorenzen, CFP®, AIF®

Are you seeking a fiduciary advisor? If so, you’ve found one! I am an independent CERTIFIED FINANCIAL PLANNER® professional and a fiduciary advisor. In fact, I’m an ACCREDITED INVESTMENT FIDUCIARY.® You can see more about my background here.

Of course, you’re probably wondering if you’ve found the right advisor for you… an advisor with long experience and respected credentials,

I’m Jim Lorenzen. Retirement has been specialty since I first hung out my shingle back in 1991. Since then, I’ve been helping people nearing or in retirement with their planning and execution of investment and tax strategies designed to preserve wealth so they can sleep at night not having to wonder where there money is.

Advisors are different from brokers. See how.

Speaking of where their money is: I do not take custody of client funds at any time. Client money is on deposit with an independent SEC registered custodian in accounts titled in their names (or the names of their trusts). Typically, my clients’ funds are their own accounts with Pershing, a division of Bank of New York-Mellon.

Whether you’ve saved a half-million or ten million, turning your life savings into a stable tax-efficient retirement income is one of the most consequential financial decisions you will ever make.

Why work with an independent solo practitioner? In a word: independence. Clients shouldn’t have to wonder who their advisor really works for. Another word you may have heard before: fiduciary – one that gets a lot of use these days. As a registered investment advisor, I’m a fiduciary by law. More on my fiduciary status below.

IFG is an independently-owned financial planning and registered investment advisor specializing in retirement and retirement income planning. IFG serves private clients seeking quality fiduciary advice. IFG does not sell investment products and is proud of the lasting client relationships formed since IFGs formation in 1991. I am a CERTIFIED FINANCIAL PLANNER® professional and an ACCREDITED INVESTMENT FIDUCIARY® with a focus on retirement planning since I first opened my doors in 1991. You can learn more by viewing the video on my Home Page.

All Financial Credentials Aren’t Created Equal

There’s a distinct difference between a certification and a designation, though many use the terms interchangeably. Certification is accredited: it requires impartial, third-party validation from a credentialing program – the certifying body cannot be affiliated with the education provider and therefore conveys a higher standard of excellence. It’s more sustainable than a designation because an accredited program must continually update their requirements to maintain relevance.  For example, the CFP® Board certified financial planning curriculum is now offered in both undergraduate and postgraduate degree programs at more than 300 accredited colleges and universities across the United States. Graduates planning to become CFP® professionals must sit for the CFP® Board exam, given twice a year on the same date in selected locations across the United States.

For example, the CFP® Board certified financial planning curriculum is now offered in both undergraduate and postgraduate degree programs at more than 300 accredited colleges and universities across the United States. Graduates planning to become CFP® professionals must sit for the CFP® Board exam, given twice a year on the same date in selected locations across the United States.

Putting this in perspective: An advisor with a designation tailored to a specialty can’t effectively plan a client’s retirement unless s/he knows how it affects other areas of the financial plan. An analogy: If someone wants to become an anesthesiologist, s/he doesn’t simply go to anesthesiology school. The first stop is medical school learn how each part of the body interacts with the others. Once they have a medical degree, then they go to anesthesiology school. So, if someone specializes in a narrow area and is not a board-certified CFP®, some unintended consequences may bring unhappy surprises down the road.

The “Fiduciary” Handle Can Be Confusing

The “Fiduciary” Handle Can Be Confusing

Maybe you’ve heard of “the F word”: Fiduciary. Many people are becoming aware that all advisors aren’t alike, though a lot of misinformation, some even coming from lawmakers, and tv advertising is blurring this important distinction. Talking about “best interests” and accepting true fiduciary status are two very different things.

The operative question: Will your advisor accept fiduciary status for all services in writing?

Many advisors working for broker-dealers talk about working in the their clients’ “best interest”, even pointing to recent SEC rulings; however they do not – in fact, may not even be allowed to – accept fiduciary status for all advice and transactions for client accounts… and certainly not in writing. Nowhere in the new regulations is the word ‘fiduciary’ used and ‘best interest’ isn’t defined. And, since many major firms register as both “advisors” and brokers, they can still change hats. it’s still business as usual, it seems.

Those who are ‘pure’ Registered Investment Advisors (RIAs) are held to a fiduciary standard by law; and independent RIAs work for only one employer: The client. There’s a tv commercial featuring an advisor who says ‘… at ______, we’re different. When our clients do better we do better…. we’re different.’ They’re not different. In the RIA world, they’re the norm. They love talking about no conflicts of interest. Here’s my take.

At IFG, you get an independent advisor embracing fiduciary status, experience, and credentials. IFG clients work directly with me. You can learn more about my background here.

Is my practice the right fit for you?

My services are designed for people who value independent, objective advice. They’re focus is on the serious issues of longevity, taxation, inflation, etc., and still manage to keep a sense of humor.

My services are NOT ideal for people who react to daily headlines, are trying to ‘beat the markets’, emotionally invested in theories and myths, and don’t have a sense of humor.

Although there is no minimum requirement, IFG’ services are most appropriate for clients with $500,000 or more to invest and who are seeking qualified, independent and objective comprehensive planning and advice from a fee-based fiduciary advisor, with a fee structure that is clear and easy to understand. To learn more, arrange your introductory call today!

Your advisor should act as an educator and coach. And, coaching DOES make a difference! See How to Get Value from an Advisor Relationship.

Studies have shown that most Americans are woefully unprepared for retirement. Indeed, many wait until they’re about to retire before beginning to plan for the very first time!

The real value of an advisor may be due to the education and coaching process a client receives. This is this has been shown to help advisory clients reach their full financial potential.

Those who do plan in advance do better! How much? According to an independent research study by Vanguard Funds, a company with a long-established reputation for low expenses and consumer advocacy, published a paper for the profession regarding the long-term value of using a retirement planning advisor for planning, implementation, and followup and found it does outweigh the so-called ‘costs’, and by more than most would suspect! A study by both Envestnet and Vanguard came to the same conclusions. The Envestnet study can be found here. (In case some of the terminology may be unfamiliar, 100 basis points (bps) = 1.00%.)

Financial Planning and Investment Advisory Practice Profile

IFG is a Registered Investment Advisor provides independent retirement income planning and wealth management advice to serious clients seeking objective help from a qualified retirement planning advisor. You can learn more by downloading IFG’s Practice Philosophy and Profile.

IFG is a Registered Investment Advisor provides independent retirement income planning and wealth management advice to serious clients seeking objective help from a qualified retirement planning advisor. You can learn more by downloading IFG’s Practice Philosophy and Profile.

Founding principal Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional, as well as an ACCREDITED INVESTMENT FIDUCIARY® who began independent practice in 1991 and now serves clients both within and outside California. You can learn more about Jim here.

Founding principal Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional, as well as an ACCREDITED INVESTMENT FIDUCIARY® who began independent practice in 1991 and now serves clients both within and outside California. You can learn more about Jim here.

IFG believes in straight talk. If you would like to arrange a short introductory phone call with Founding Principal Jim Lorenzen, here’s how you can get started.

The IFG Client Profile

Since 1991, IFG has been serving private clients and their families, who are concerned about future taxes and inflation and want greater predictability for their financial futures by establishing strategies and ‘auto-pilot’ solutions requiring less effort.

People preparing for retirement:

-

-

-

- Private clients preparing for retirement. Often they are executives and business owners for whom 401(k) contributions are not enough and are seeking greater tax-efficiency, or simply those nearing retirement and concerned about wealth preservation.

-

- Conservative – Not interested in stock tips, trends, or the latest investment fad.

-

- Focused – Knows the difference between education and financial entertainment; does not get advice from television gurus.

-

- Long-Term Oriented – Does not let daily news (financial, economic, or any other) impact decision-making.

-

- Willing to learn – Education plays a large part in the IFG service process. Clients should understand the “why” behind their plan and its components; and, quite often, real education can be in conflict with the ‘sound bite entertainment’ put forward by the media, whose only concern is ratings.

-

- Understand the value of professional guidance. It’s not about ‘beating the markets’ or overcoming an annual expense ratio, as the consumer media would have people believe. Most often, the value is achieved through tax reduction, risk mitigation, or simply avoiding mistakes. Value provided in those areas often dwarf their attendant costs.

- Appreciate “straight talk” – Straight talk can sometimes be in conflict with what people want to hear or expect, based on something they’ve heard or seen. Helping clients achieve their long-term goals is something IFG takes seriously. It’s simply about doing what’s right and makes sense.

-

-

What IFG Provides

Not all planning assignments are alike; but the types of services that are typical in many planning projects include:

-

-

- Situation analysis

- Goal setting and prioritization

- Assessment and analysis of risk profile

- Budgeting and cash flow analysis

- Analyzing the impact of concentrated positions on overall portfolio

- Developing asset allocation strategy and investment policy

- Developing tax-advantaged and efficient wealth management strategies including optimized Social Security and retirement draw-down strategies with capital needs vs market-exposure stress-testing

- Searching and selecting appropriate portfolio components and investment managers

- “Safe money” options that provide a competitive return with no downside risk while maintaining liquidity and building security

- Tax-advantaged strategies for wealth building and preservation while providing for future security

- Independent third party reporting – unrelated to IFG or the managers and/or investments they cover.

- Monitoring investment performance

- Coordination of estate and tax planning

- Consulting on current and post-career business interests, including transition strategies.

-

How to get value from your relationship with a qualified retirement planning advisor? – See our guide.

Minimizing Uncertainty

While certain components of the wealth management process can feature guaranteed solutions, it’s important to understand that, more often than not, the planning and management process is about probabilities arrived at through extensive back-testing and ‘stress-tests’ using sophisticated technology combined with common sense.

You can learn more about the IFG approach to asset management by downloading the IFG Investment Philosophy. You’ll find it straightforward.

All financial and retirement planning, as well as all investment advisory services, are provided on a fee-only basis.

IFG clients have access to virtually the entire investment universe of investment choices, including institutional-level asset management in separately managed accounts optimized for tax efficiency. You can learn more about IFG’s screening and selection process here.

For some accounts, low-cost index mutual or exchange-traded funds (ETFs) are recommended. IFG utilizes only no-load, no-commission, and no surrender charge investment solutions. IFG does not receive commissions or any other compensation of any description from third party investment service providers. In addition, clients have 24/7/365 access to their accounts, as well as up-to-date tax and performance reporting direct from the asset custodian.

Insurance Solutions

In those cases where insurance is a desired solution component, our screening begins with only “investment grade” carriers. While virtually every company touts high ratings, it’s worth noting that almost all the rating agencies are paid by the carriers they rate. Knowing what’s ‘under the hood’ in the company’s investment portfolio is important. Some very highly-rated companies have gone under simply because the rating agencies didn’t know(?) what was happening.

It’s also important to understand how the companies treat existing policyholders vs. new sales.

Insurance-based solutions, normally not requiring continuous ongoing management oversight, so ongoing advisory fees would seem inappropriate. Therefore, insurance services are provided on a commission basis under California license 0C00742. IFG is independent of all carriers. Solutions chosen, when required, are chosen based on both the carrier’s track-record, financial stability, and ‘best fit’ for meeting the client’s objectives.

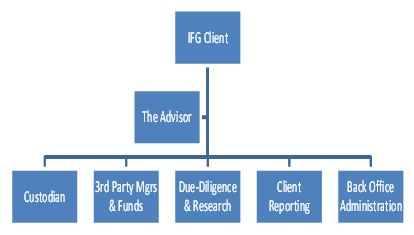

Who is The Independent Financial Group?

The Independent Financial Group isn’t a group of people working for IFG; the name depicts what IFG provides for clients. Too often, investors are steered to “bundled” solutions packed with hidden fees and back-door compensation arrangements. As you’ll see below, IFG unbundles these services, and their providers, to create a custom-tailored, transparent solution. This puts the client in control, not the providers.

The Independent Financial Group isn’t a group of people working for IFG; the name depicts what IFG provides for clients. Too often, investors are steered to “bundled” solutions packed with hidden fees and back-door compensation arrangements. As you’ll see below, IFG unbundles these services, and their providers, to create a custom-tailored, transparent solution. This puts the client in control, not the providers.

The Independent Financial Group name refers to YOUR group of independent financial resources – not IFGs – chosen and custom-tailored to meet YOUR specific needs and to meet YOUR specific goals… all with the help of a qualified, experienced advisor.

-

-

- Independent advice from a qualified advisor

Financial Planning: CERTIFIED FINANCIAL PLANNER® professional

Investment advice: ACCREDITED INVESTMENT FIDUCIARY®.

Insurance: Non-captive independent agent (California license #0C00742.

Learn more about IFG’s Founding Principal, Jim Lorenzen

- Major “brand-name” custodians – IFG does not take custody of client assets at any time.

- Independent due-diligence: 2 layers

(a) independent third-party due-diligence at the institutional level plus – not related to the managers and institutions they cover.

(b) at the advisory/client level utilizing a ‘best interests’ fiduciary standard vs. a suitability standard. Note: The Independent Financial Group is a Registered Investment Advisor bound to a fiduciary standard of client care. - Independent third-party institutional reporting: Unrelated to the managers they cover.

- Independent investment selection and management – unrelated to the parties conducting due-diligence.

- State-of-the-art industry-leading technology – independent and unaffiliated with institutional custodians or investment providers. Our platform, created by PIEtech, enhances the client-advisor collaborative effort and provides an easy/intuitive client interface. One of the reasons IFG can collaborate with clients in Florida as easily as with clients in California.

- Independent advice from a qualified advisor

-

Transparency. This puts the client in control.

-

-

- An experienced and credentialed Certified Financial Planner® (CFP®) professional advisor

- Independent advisory services grounded in a sound investment philosophy.

- Custodial services independent of the advisor

- Reporting services independent of the advisor and the custodian

- Account management independent of the advisor, the custodian, and the reporting entity

-

Are You STILL Working with a retail broker?

The creation of IFG meant moving away from the old paradigm (the advisor working as a captive rep for a firm)….

The Old Organization Paradigm

The New Paradigm investing structure features an independent advisor working solely for the client in an ‘unbundled’ environment without hidden compensation. Investment service providers serve the client independently avoiding revenue sharing and other conflicts of interest. The result: YOUR independent financial group dedicated to putting YOUR interests first. You are the CEO, and the advisor acts as your personal CFO.

You can learn more about my compensation policy here.

You can hear Jim Lorenzen talk about The IFG Difference here!