A client once asked me, “What’s your secret”? (I wasn’t setting the world on fire; he was just happy with what I’ve been doing).

‘The secret’ is not having one. Watch the gurus on tv: they all seem to have the ‘system’ or a strategy no one else has. They’re great sales people, though. They make a lot of money because most people will buy something based on one of four basic motivations: fear, gain, pride, or imitation. If you’re not appealing to one of those, it’s hard to get attention – and the slick gurus know that.

My investment philosophy is pretty simple; and, it’s not one that appeals to any of the four basic motivators the gurus use:

Stick to what you know; know what you don’t know; and don’t do stupid things.

It’s your nest-egg. There are no do-overs.

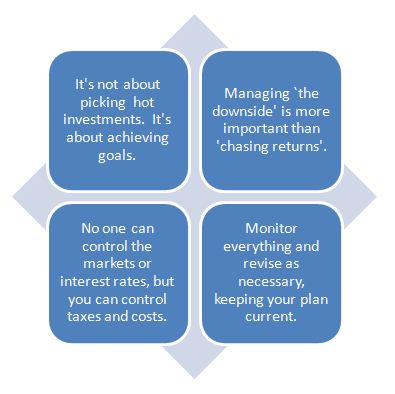

There are four basic pillars:

Not very exciting. It doesn’t get anyone running to their phones.

It isn’t about becoming an investment genius. It’s about the plan and having a discipline.

So, why use an advisor? The second sentence above probably says it best. It’s the same reason you’d use an architect: a home built without a blueprint probably won’t turn out too well. The way your financial house looks in ten or twenty years will no doubt be influenced by the planning, or lack of planning, decisions that are made today.

Advisor value is often added in the areas of tax efficiency, risk management, and strangely enough, cost control. Social Security claiming mistakes, for example, often costs some people tens of thousands of dollars. Tax planning can also make a huge difference in outcomes years down the road. Required minimum distributions in retirement may very well affect the taxation of your Social Security benefits, as well as your Medicare Part B premiums. The list goes on.

Building your dream home? Hire an an experienced architect. Building your dream future? Well, you know. You need a good blueprint, either way. Otherwise, you might not like the outcome.

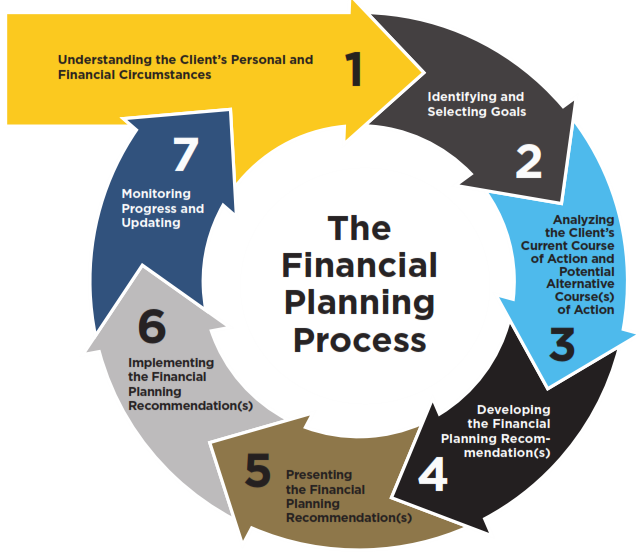

What does the basic process look like?

- It begins with you. You can’t find the store you want in the mall until you find that X on the mall directory that says ‘you are here’. You wouldn’t want your doctor to prescribe a treatment without conducting an examination and providing a diagnosis. This step should be no surprise to anyone.

- It’s best to know what you want your house to look like before we begin ordering out materials.

- Has what you’ve been doing so far been working? Can it be improved?

- A preliminary plan is developed, however….

- Planning is a collaborative process. This is where your input and tweaking may be necessary to arrive at the final approach everyone is comfortable pursuing: you have to be comfortable knowing it’s exactly what you want and I have to be comfortable it’s in your best interest and we’re not doing anything stupid.

- The plan is implemented, and…

- We have regularly scheduled meetings to monitor your progress and make sure we’re on-track. Remember Pillar #1 at the top of this page: we don’t care if we beat indexes – the only index that matters is if you’re achieving your financial goals.

So, why would you consider working with me?

- Independent and Objective. Financial planning and investment advisory services are provided on a fee-only basis. IFG does not accept commissions or third party compensation for these services. Insurance products, which do not require ongoing management oversight, are not included on the annual fee structure. Compensation for the use of these products, where desired, is derived from the insurance carrier..[1]

- Minimize expenses. Use passive low-cost investments wherever feasible. Use active institutional management when value can be added to reduce volatility, increase predictability, and/or increase tax efficiency.

- Fiduciary Status. As a Registered Investment Advisor, IFG embraces fiduciary status on all client investment accounts. I am willing to put my fiduciary status in writing. Learn more about the fiduciary standard Download the The Fiduciary Standard.

Arrange your introductory ‘right fit’ phone call today using our convenient scheduler!