A recent study by Morningstar, a leading mutual fund research firm, compared mutual fund returns with the gains individual investors actually received. The study found that investor returns typically lagged fund returns. The reason: Investors tended to move cash in and out as markets would rise and fall, often buying high and selling low.[1]

The study covered 10 years through the end of 2012, and found that funds posted an average annualized return of 7.05%, compared with a 6.1% average return realized by investors. (The returns factor in all stock and bond funds that Morningstar tracks. Investor returns are weighted based on asset owes into and out of all share classes of open-end mutual funds tracked by Morningstar. [To learn more on why many individual investors have trouble reaching goals, see your report, Why Most Financial Planning Will Probably Fail.

Although a gap of a single percentage point may not seem like a big difference, it can make a significant impact over the long term, thanks to compounding. In fact, a hypothetical $10,000 investment returning an average of 7.05% annually would produce a total of $19,856 over 10 years compared with $18,078 for an average annual return of 6.1% over the same period. Over 30 years, the gap becomes even wider: $78,286 for the 7.05% return vs. $59,082 for the 6.1% return.[2]

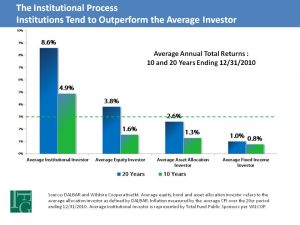

The findings in the Morningstar study are apparently no fluke. Similar findings were discovered in a study by Dalbar back in 2010 (see graph).

The findings in the Morningstar study are apparently no fluke. Similar findings were discovered in a study by Dalbar back in 2010 (see graph).

What’s the reason for this? While I have admittedly not conducted a back-tested analysis on this, I do have what could be considered an informed opinion. It’s investor behavior – to be sure not a ground-breaking epiphany.

When investors buy in good markets and sell in bad ones, they generally lose – no news there. What is worth consideration is something Warren Buffett said years ago: If you think investing is fun, you’re doing something wrong. Real investing is boring; what you see on tv is financial porn. However, if you’re investing properly, you will virtually always be buying low and selling high.

Why? It’s as simple as having a properly constructed portfolio, designed to implement your formal financial plan, and adhering to a disciplined rebalancing process. Not all financial plans are sound, however. See our report.

Rebalancing is key. Regardless of your rebalancing schedule,[3] it helps ensure you will be selling high and buying low. Important: Rebalancing does not guarantee gains nor does it guarantee against loss; but, it sure beats trying to ‘call’ markets.

Let’s use a simple hypothetical example using a simple stock and bond portfolio. If your financial plan indicates the best balance for you is 60% bond and 40% stocks and your investment portfolio is valued at $500,000, you’d be allocating $300,000 to bonds and $200,000 to stocks.

Using easy to grasp numbers, let’s assume that when it’s time to rebalance, based on a schedule you and your advisor have chosen, your bonds have lost 10% in value, due to rising interest rates while your stocks have gained 20%.

Your bonds are now valued at $270,000 (down by $30,000) and your stocks are now valued at $240,000 (up by $40,000). Your total portfolio is now valued at $510,000. Not bad, but our schedule says it’s time to rebalance and we do believe in investment discipline.

40% of $510,000 would indicate a stock allocation of $204,000; but the current value of that portfolio is $240,000 due to the run-up. That means trimming our stock exposure by $36,000 – we’re automatically “selling high”.

Our bond portfolio, now valued at $270,000 is down $30,000 due to rising interest rates. At a 60% allocation, we should have $306,000 (60% of $510,000) in bonds. Obviously, that’s where the $36,000 from our stock sales will go. We’re “buying low” into a rising interest rate market.

In the real world, portfolios aren’t quite so elementary. There are investment styles within each asset class and there are sectors within each style. It can get rather sophisticated, but technology helps.

You may have heard it a thousand times; it still bears repeating: It begins with a plan. If you don’t have one, you’re lost – and if you think you have your plan in your head, your heirs will be helpless, even if you aren’t already.

[1] Russel Kinnel, “Mind the Gap: Why Investors Lag Funds,” Morningstar, February 4, 2013.

[2] Results are for illustrative purposes only and in no way represent the actual results of a specific investment.

[3] Transaction costs and tax implications should not be ignored.

As I noted earlier, many plans will likely fail. See our report. Hope you find this helpful.

If you would like help, of course, we can always visit by phone.

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.