There may be times when you might decide it’s worth claiming your Social Security benefits early!

Here’s a hypothetical possibility: Margaret is 62 years of age, married, and has about $5 million in retirement assets from her recently sold business with all taxes paid. Her monthly expenses are about $8,000 monthly and has no other income. Her expenses are reasonable, given her asset level.

She doesn’t need her Social Security income. Should she claim early or late? Consultant’s answer: it depends.

Her benefit at full retirement age would be $2,800. If she claims early, at 62, she would receive only $2,007; but if she waits until age 70, she would receive $3,547 monthly! Big difference! So, what’s best? Again, it depends. On what?

What does she want the money to accomplish? She doesn’t need the money; so what does she intend to do with it?

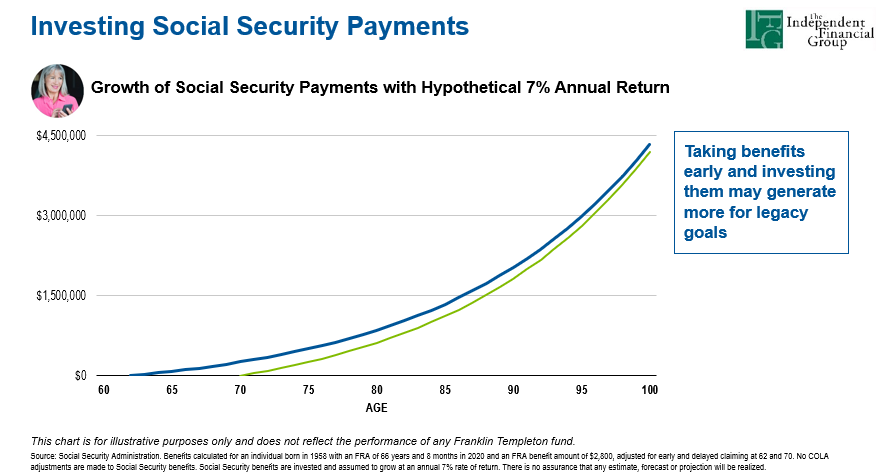

She ways she wants the money to leave a legacy for her children and grandchildren. That’s a long time! If we were to compare beginning now at age 62 with waiting until age 70 with all the income invested for a long-term goal of a 7% return, would the increased income by waiting to age 70 make up for the the eight years of time lost investing the lesser amount? If 7% is assumed, it may pay to begin now.

As you can see, if investing the money for legacy is the objective, maybe claiming early and aggressively investing over the long term may be the ideal choice! Social Security planning should be integrated with your total financial plan; after all, benefits can be subject to income taxation and beginning early to lay plans for minimizing those can critical to long term success.

If you’d like to find out if IFG is the right fit for you, just go to the Getting Started tab above, or click here, to arrange your ‘right fit’ introductory phone call!

Food for thought.

Jim