… and what it means to your retirement income – particularly your Social Security taxation in retirement.

… and what it means to your retirement income – particularly your Social Security taxation in retirement.

Jim Lorenzen, CFP®, AIF®

Most people believe that municipal bond interest is tax-free and won’t affect taxation on their retirement income. Well, it is, I guess; but, there are tax ramifications few people have heard about. It’s called “provisional income”.

Huh?

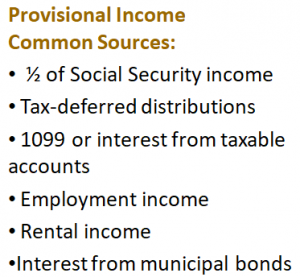

There are categories of income which, when added up, determine how much provisional income you’ve received in a given year. And, during retirement, when you’re likely receiving Social Security income, the amount of provisional income you receive determines just how much you’ll pay in taxes on your Social Security Income.

As you can see, when adding up your provisional income, it begins with 50% of your Social Security income. Then they add in all distributions from tax-deferred accounts. If you’re in retirement, that includes money you’re taking from your 401(k) or IRAs (except distributions from a Roth IRA, which are generally tax-free, and any money you’ve taken from a properly-structured permanent life insurance policy (withdrawals up to your cost-basis and policy loans). And, as you can see, municipal bond interest is counted.

As you can see, when adding up your provisional income, it begins with 50% of your Social Security income. Then they add in all distributions from tax-deferred accounts. If you’re in retirement, that includes money you’re taking from your 401(k) or IRAs (except distributions from a Roth IRA, which are generally tax-free, and any money you’ve taken from a properly-structured permanent life insurance policy (withdrawals up to your cost-basis and policy loans). And, as you can see, municipal bond interest is counted.

Once you’ve added up all your provisional income, how much do you owe in taxes? Well, it depends. Here are the provisional income thresholds.

If you’re a married couple and your provisional income is below $32,000 for the tax year, you will pay no txes on your Social Security income. If your income is over $44,000, however, then 85% of your Social Security income will be taxable. The whole idea was part of a package passed back in the 1980s to save Social Security. One thing they didn’t do: index it for inflation.

So, as your 401(k) grows and your assets grow–more importantly, as inflation continues through the years and it will require greater withdrawals for you to live in retirement–the greater the likelihood you’ll be paying taxes on your Social Security. It doesn’t take much to get past $44,000 in retirement.

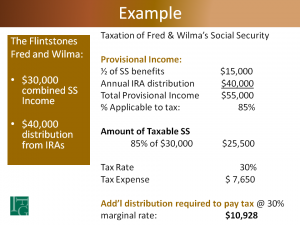

Let’s take a quick look at an example: Fred and Wilma. They have $30,000 in combined Social Security income and also take $40,000 annually from their IRAs, giving them a $70,000 income in retirement.

For computing their provisional income, only half of their Social Security income is used. Added to their IRA distributions, they have $55,000 in provisional income, meaning that 85% of their Social Security income ($25,500) is taxable at their tax rate. If they’re paying taxes at 30%, their tax bill will be $7,650.

But if they need the entire $70,000 they’ve taken as income, they’ll have to take an additional distribution just to pay the tax bill, and, oh yes, it’s taxable, too.

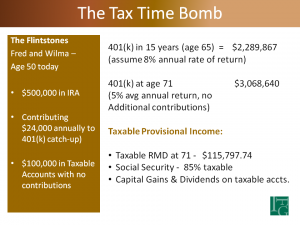

But, Fred and Wilma have another problem they’re likely completely unaware of. There’s a ticking time-bomb growing inside their 401(k). It’s growing.

How can that be bad? Well, it isn’t, of course, but it might come at a huge price. If history has taught us anything, it’s that governments exist to get re-elected and they help insure than through spending which never seems to get undone. Our nation’s huge debt is growing and the money to pay the bills will have to come from somewhere–and it won’t come from people with no money. With an ageing demographic bubble moving into the decumulation stage and wanting more services, particularly health care, the long-term outlook for taxes can’t be too encouraging. Let’s get back to Fred and Wilma:

If Fred’s 401(k) continues to grow at an 8% average annual rate until he’s 65, he’ll have a balance of over $2 million! And, at age 71, when he’ll be required to take required minimum distributions (RMDs), his balance will be over $3 million–requiring RMDs of over $115,000 annually.

If Fred’s 401(k) continues to grow at an 8% average annual rate until he’s 65, he’ll have a balance of over $2 million! And, at age 71, when he’ll be required to take required minimum distributions (RMDs), his balance will be over $3 million–requiring RMDs of over $115,000 annually.

Fred and Wilma will be paying a lot of taxes.

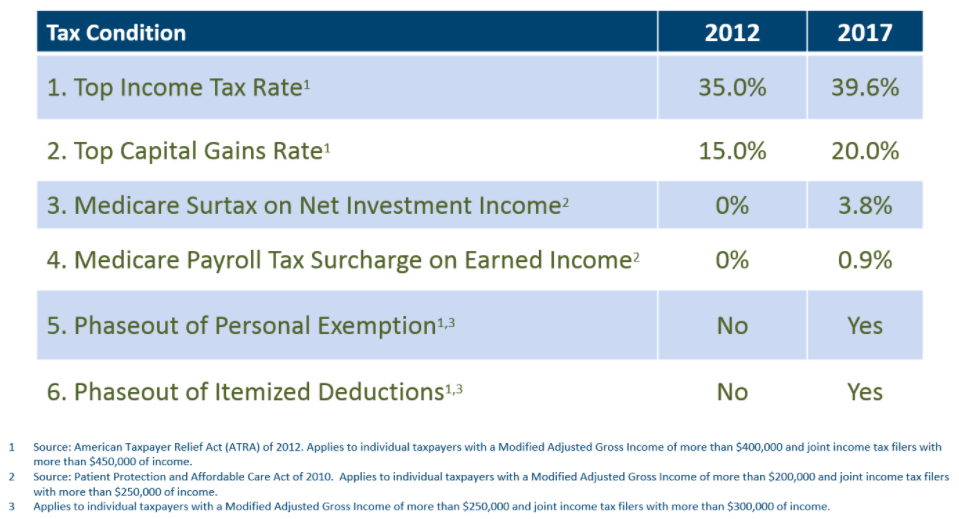

And, as mentioned earlier, the long-term outlook for taxes isn’t likely very good. Just take a look at the differences from 2012 to 2017.

How can Fred and Wilma mitigate, and maybe eliminate, their income tax payments in retirement?

Under current tax law, each has a personal exemption of $4,050, so they have $8,100 incombined personal exemptions. They also have their deductions. If they’re using the standard deduction, they’ll have $12,700 too, giving them a total of $20,800 in exemptions and deductions. So, their key is to keep their taxable income below $20,800. All income above the standard deduction and personal exemption is subject to tax.

The good news is that Fred and Wilma are still in their 50s and there’s plenty of time to plan. Working with their Certified Financial Planner®professional, they can begin “reverse –engineering” the placement of assets in a way they can still grow their nest-egg, but re-arrange their ‘tax buckets’ so Uncle Sam becomes less of a partner–or no partner at all, which would be the ideal making their tax-jockeying a moot issue. You can get our piece on 4 Steps to a Tax-Free Retirement. I think you’ll like it.

The good news is that Fred and Wilma are still in their 50s and there’s plenty of time to plan. Working with their Certified Financial Planner®professional, they can begin “reverse –engineering” the placement of assets in a way they can still grow their nest-egg, but re-arrange their ‘tax buckets’ so Uncle Sam becomes less of a partner–or no partner at all, which would be the ideal making their tax-jockeying a moot issue. You can get our piece on 4 Steps to a Tax-Free Retirement. I think you’ll like it.

Enjoy!

Jim

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.