Which goal is most important to you?

– Never running out of retirement money

– Never running out of retirement income

– Both

Sure, you said both. And, maybe that’s possible!

The problem for many is that not only are substantial assets required to provide a comfortable retirement income – you also have to live a lifestyle below what many would believe you could afford.

I have a client couple who have done just that. They’ve worked hard, invested responsibly, and lived well within their means allowing them to save at a rate greater than what would appeal to many others. The result: They’ve been able to retire in their late ‘50s in a beautiful area – and doing it at a time their son graduated from college and is now entering grad school. How many parents could afford to retire with a child entering grad school? In short, they’re set! They’ve taken all the right steps to insure their future, even into their 80’s and 90s… and even if everything in “the markets” went south on them.

I’ve also seen others who have amassed ten times that couple’s assets, but are living at a lifestyle that keeps them in perpetual jeopardy. They’re constantly in danger of running out of money. Their lives are like a hamster running on the spinning wheel, constantly chasing the cheese. The lesson: Even people with $30 million dollars can still be on the edge of disaster. Think of all the multi-million dollar sports and entertainment figures who’ve ended-up broke, sometimes due to poor management, sometimes due to overspending, sometimes both, virtually always because of ignorance…. either on their part or the part of their ‘managers’, or both.

What kind of retirement income or wealth management strategy makes sense any given investor? Naturally, it depends on age, goals, asset level and lifestyle. It also depends upon what type of strategy the individual is open to considering – most of us have built-in biases based on how we’ve been programmed.

Given the level of financial literacy in America today, it’s a real concern. Most of what people know about financial instruments they’ve learned from entertainment gurus, their parents, or their friends. I saw a recent study that revealed more than 31% of Americans didn’t know they could lose money in fixed income investments; and 68% thought rising interest rates would be good for bonds… all while 60% said they don’t consider themselves knowledgeable regarding fixed income, the market, or economic forces that drive bond pricing.

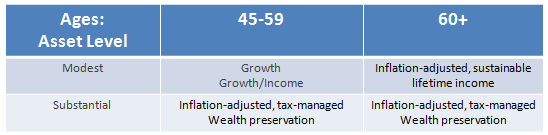

Generalizations are always dangerous; but hey, you’ve have to start somewhere, right? So, let’s begin, as a starting point, with this basic admittedly oversimplified outline of what an overall retirement strategy might be:

You might be wondering why those below age 45 aren’t included in my little over-generalized grid. The answer is simple: In 25 years’ of practice, only ONCE has someone below age 45 come to my office. That was almost 20 years ago and I haven’t seen anyone in their 40s come to my office since – they’re still watching Kramer – but, I’ll see them after they turn 50 and finally figured something out they don’t know today.

Back to our grid:

The definitions of “modest” and “substantial” are somewhat squishy. It’s like trying to define what a ‘middle-market’ company is – you can ask a hundred people and get a hundred different answers. So, let’s just say the definition is whatever you think it is.

If you’re worried about running out of money, you might consider yourself to be a “constrained investor” – and you probably shouldn’t be trying to ‘make up for lost time’ by making risky bets.

If you’re like the couple who’s sitting pretty and just doesn’t want to blow it, you might be preservation minded – someone who wants to maintain their lifestyle after inflation and taxes and not do anything stupid. [See my blog post, “Inflation and Stocks” here.]

Back to our initial quiz:

Which worries you most: Running out of money or running out of income?

You can have an income forever; but, it may not be enough to even pay your utility bill if the asset base is too small; and, if you

run out of money, there’s no income.

Navigating it all is much like navigating a ship at sea, surrounded by all sorts of potential hazards.

Too much to cover in a single post, as you might imagine; so, we’ll be covering the issues and strategies you can use in upcoming installments. I hope you’ll find them helpful.

If you would like help, of course, we can always visit by phone.

Enjoy!

Jim

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.