Meanwhile, the Federal government is running a record debt—and, it’s worse than the numbers you hear on the news. I’ll get to that and your tax free retirement chances soon; but, for now, it’s worth recognizing one simple fact: The government needs money—and that means increased income tax rates are probably on the horizon.

The problem for boomers is right under their noses: They’ve been deferring taxes for decades on the “seed money” they’ve been using to fund their 401(k) plans. Now, just when the government needs money the most, these same boomers are poised to withdraw a large harvest—and pay taxes on the tax rates in effect from this time forward.

There are three reasons taxes will likely rise:

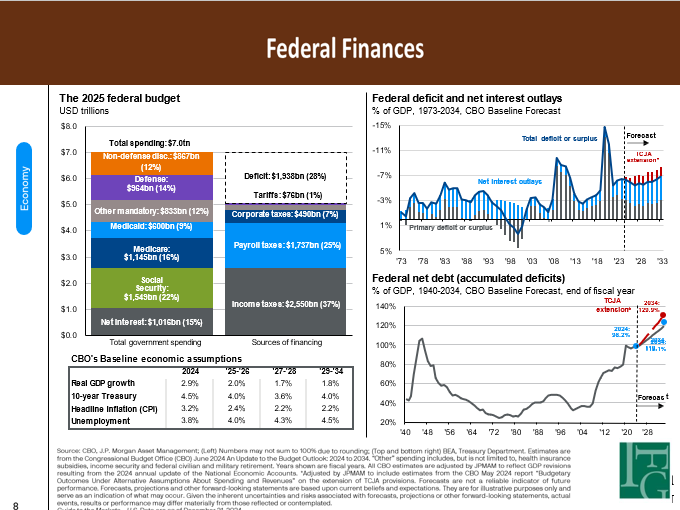

1. The Federal Debt

Despite recent reductions in the annual deficit (upper right), the deficits continue to accumulate and are projected to climb. As you can see the debt has continued to increase

What’s more, the government doesn’t use recognized accounting standards. As I mentioned, it’s worse than you might think: only current year obligations are used.

Example, if you purchased a $50,000 car, you would expect to enter a $50,000 liability on your balance sheet. The government does it differently, entering only the total of the current year’s payments.

Don’t you wish you could build your balance sheet the same way?

Suppose you had only to list your current year’s mortgage payments on the liability side of your balance sheet, instead of the total outstanding mortgage obligation. That should tell you something about the federal debt figure you see on the news.

As I write this, the federal debt more than doubled, from $9 trillion to more than $18 trillion in just seven years. In other words, we’ve added more debt in seven years than the United States accumulated over its entire history before March of 2008. And the real debt, using accepted bookkeeping standards, was estimated to be more like $87 trillion – and that was back in 2012!

[Source: http://townhall.com/tipsheet/guybenson/2012/11/28/americas_true_national_debt_87_trillion]

2. Reduced Federal Income Tax Revenues

While unemployment has been heading down, the raw numbers don’t tell the whole story. Those finding work seem to be taking lower-paying or part-time jobs. They’re working, but for less and/or with fewer hours.

Wage growth remained below its 40-year average for almost 30 years and has been trending downward since the melt-down with only a recent turn to the upside. However, that recent upturn appears weaker

than prior upturns going back to the late 1980s.

Wages remaining below their 40-year average resulted in less income tax revenue for federal coffers.

3. Current Income Tax Rates are Historically Low

Marginal tax rates haven’t been this low since the early 1930s. During much of the 1940s, 50s, and 60s, the top marginal income tax rates were over 90%.

As income tax rates have declined since the 1960s, Congress has taken away deductions. Now that rates are historically low and the debt has virtually doubled just since 2009, many have little doubt taxes are headed back up, especially since the Feds are taking in less tax revenue. Few expect a reinstatement of the deductions that used to be available.

The picture is clear.

Since the government needs money to repay its debt – and the huge chunk of untaxed money sits on the verge of being taxed – there seems to be little doubt, given our current historically low rates, that these rates will remain in-place indefinitely – political winds do shift from administration to administration.

Now, consider this:

If an investor does a great job, focusing on accumulating retirement assets, and the portfolio’s stocks, bonds, mutual funds, REITs, SPDRs, ETFs and other taxable retirement assets are doing well, this person has even more tax exposure. Larger tax-deferred accounts mean larger required minimum distributions. Those larger taxable distributions affect how Social Security is taxed… and also impacts Medicare premiums.

Strong performance is good, of course; but couldn’t this client arrange things so that his investments can still perform well and his partner, Uncle Sam, does less ‘relieving’?

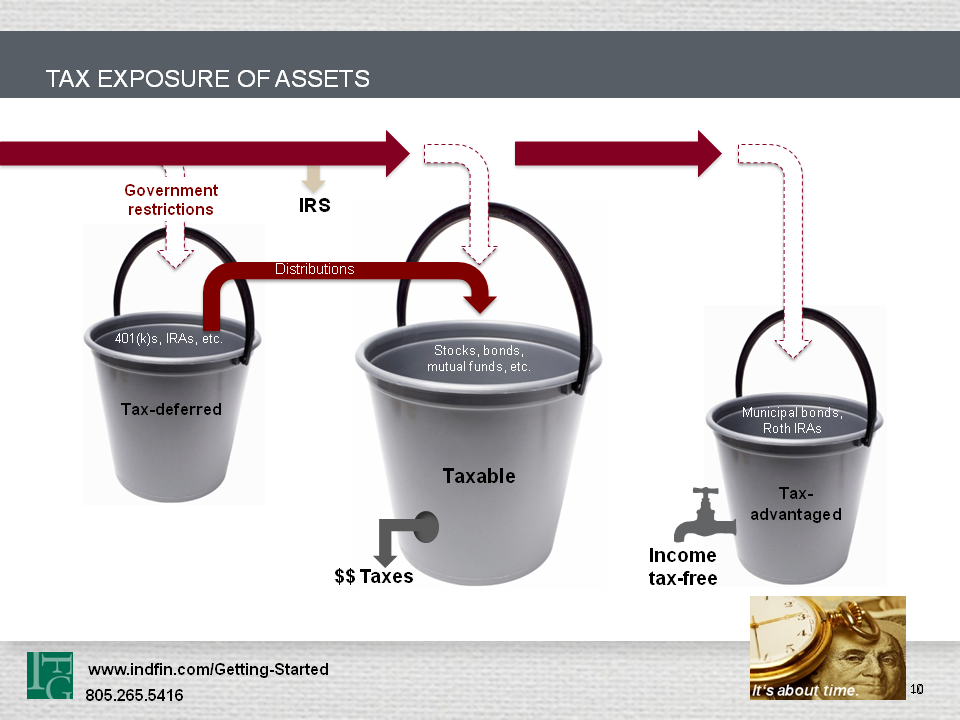

What happens to the tax-deferred bucket when our professional retires?

Simple: All those tax-deferred assets become taxable. As you can see distributions go into the taxable bucket. They never make it into the tax-advantaged bucket where distributions are income-tax free!

What’s really happening? You’re likely in a bad business partnership:

> Uncle Sam is YOUR partner in your retirement plan—and he gets a cut of whatever you take out.

> Your partner can change his share at any time; he has the ONLY vote on his share.

> Your partner is deep in debt due to overspending and needs money.

> Your partner is still spending and will likely need more money over the next thirty years

This isn’t a partnership anyone would choose for their own private business; but here we are.

Traditional Retirement Solutions

This is the way most Americans have approached retirement. Everything after the tax-deferred bucket is funded with after-tax dollars. You pay the I.R.S. and can use what’s left to invest in stocks, bonds, mutual funds, etc., in the next bucket.

The tax-deferred bucket has restrictions, of course, so that the I.R.S. can get some of your money before reaching the taxable bucket. There are no restrictions on this bucket, but it does leak taxes, as you can see.

The third bucket is the tax-advantaged bucket, which would include, for example, municipal bonds and Roth IRAs. While there is no limit on how much can be invested in municipal bonds, there are contribution limits for Roth IRAs. But, this bucket has one huge advantage: All income distributions are tax-free!

The key to strategizing a tax-free retirement is to use all three buckets in an intelligent way. A tax-free retirement is possible.

Can EVERYONE achieve a tax-free retirement?

Unfortunately no. For example, if you receive pension income that would put you over the provisional income threshold after your standard deduction and personal exemption, you’re stuck. You won’t be able to have a tax-free retirement; but you can certainly improve your tax picture by reducing your exposure to both taxes and potential tax-law changes.

There are four stages of retirement – and tax planning does change during these stages. If you’re a ‘learner’, grab some coffee and enjoy this 45-minute video on How Tax Planning Changes During the Four Stages of Retirement.

Can YOU achieve a tax-free retirement?

The odds might be very good you can; but, that would require some analysis. There’s more information on my website

You also might be interested in our report, 4 Steps to a Tax-Free Retirement.

Enjoy!

Jim