Jim Lorenzen, CFP®, AIF®

Think interest rates may be headed up in the future?

Looking for a “safe” way to produce a rising income if that happens?

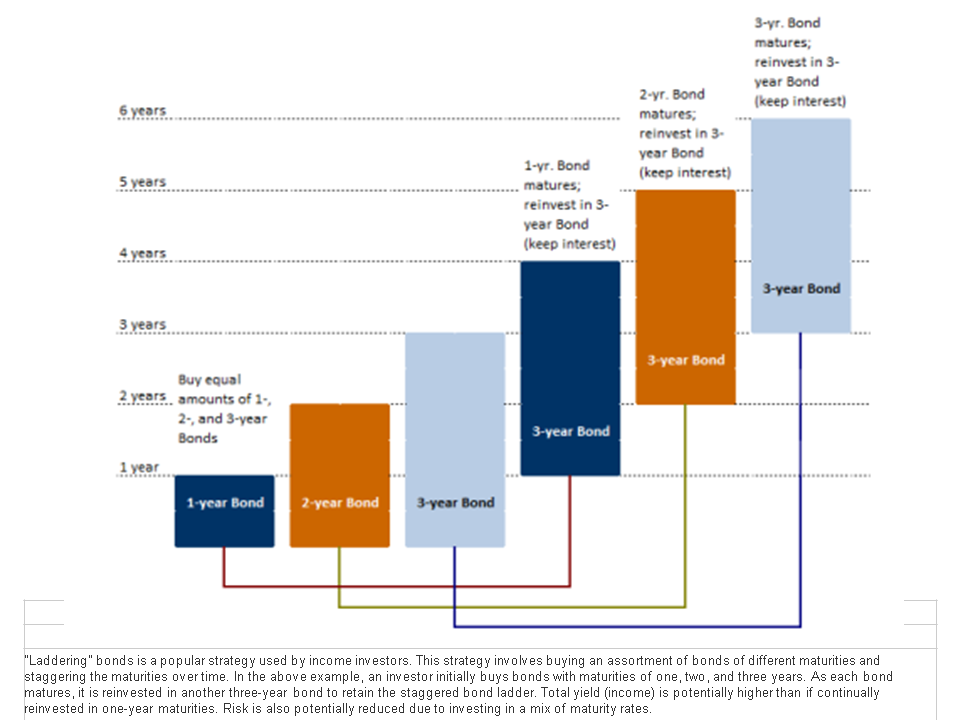

First, the good news: It’s pretty simple to do. It’s called a bond ladder, but it can be accomplished using bank CDs or virtually any other fixed-rate instrument that has a maturity date.

You simply divide your money into time frames or baskets, i.e., 1 year, 3, year, 5, year, 10 years. As each basket matures, you simply buy another basket with the same time frame.

It looks something like this:

Now the bad news: The rates may or may not keep up with inflation. And, unless held in a long-term tax-deferred account – and many aren’t because people consider this money to be ‘liquid’ emergency money – the interest is also taxable.

For example, as I write this, according to bankrate, a 5-year CD is currently paying around 1.67%. Someone in the 30% combined state and federal tax bracket would realize only 1.17% while inflation, according to the government calculations, is 1.1%. In other words, you’re treading water. And, while most people like liquidity and safety, they also don’t generally want to have a lot of money going nowhere.

There’s something else to consider, too. Given the current U.S. government debt level and the state of the U.S. economy, there is pressure to keep rates low (it’s in the government’s interest as long as heavy borrowing continues); so, rising rates may be a ways off and slow in coming at that, while inflation – and higher taxes – just could arrive first!

If you’re stuck in low interest rate accounts, there are other options available. Whether they are right for you would depend on a number of factors, which I’ll cover in an upcoming webinar entitled, Marooned With Low Rates? It’ll be held on Saturday morning, June 18th andwill be accessible to all of our ezine subscribers. If you subscribe to our ezine (see side panel), you’ll be receiving an invitation soon.

Jim

Become an IFG client! Don’t play phone-tag; schedule your 15-minute introductory phone call using this convenient scheduler!

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a fee-only registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.