Roth distributions may very well remain untaxable, but that doesn’t mean Congress couldn’t create reforms that would make these accounts less attractive, thus reducing their inflows.

Here are a couple of changes Congress could make:

(1) adding a required minimum distribution requirement, which would bring money back into taxable accounts, and/or

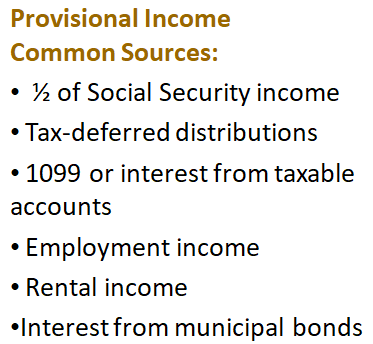

(2) including these distributions in measures of modified adjusted gross income or provisional income for determining other taxes such as on Social Security or triggering higher Medicare premiums.

The answer, if there is such a thing, might be prudent asset location.

Tax-deferred accounts should probably hold tax inefficient investments, which usually means lower returns, i.e. bond holdings. Tax-exempt accounts should likely hold tax-inefficient, higher return, investments, i.e., stocks and stock funds. Tax-efficient holdings may be best held taxable accounts.

Broad guidelines are good, but personalized advice is better. Talk with your advisor – or feel free to get in touch with me. See our “Getting Started” page!

Jim