Jim Lorenzen, CFP®, AIF®

… and what do rising interest rates (and inflation) mean to your long-term success?

Maybe less than you think… or is it maybe more than you think.

We don’t really know, do we? Planning isn’t about what we know; if it were, we’d all just go with our guts and get rich! Planning is about what we don’t know.

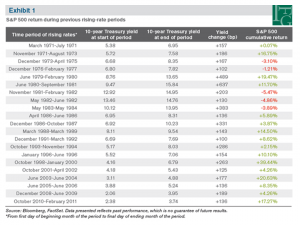

But we do have indicators. Past performance is no guarantee the future will repeat – we know that; but, maybe – just maybe – it can provide a little idea of how markets have reacted to rising interest rates in the past. Here’s a chart from Bloomberg; I apologize for the fuzziness.

As you can see (I hope) since March of 1971, there have been 21 periods of rising interest rates. Of those 21 periods, the S&P declined only 5 times and the largest decline was around 5.5%. Comforting? Well, good reading anyway.

The problem, of course, is we’re dealing with real money and real people’s lives.

It pays to have a ‘back-up’ in your financial plan that can help ensure there’s a ‘late life income’ even if everything else falls victim to the incompetency of elected officials who’ve become self-anointed economic experts.

For that reason, I thought you might enjoy a report I’ve put together about how to create a ‘late life income’ by adding another component to your investment diversification strategy.

I think you might enjoy it -it’s based on an actual case study. You can access your Late Life Income report here.

Enjoy!

If you would like help, of course, we can always visit by phone.

Jim

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.