A few Social Security claiming decisions that can cause nightmares:

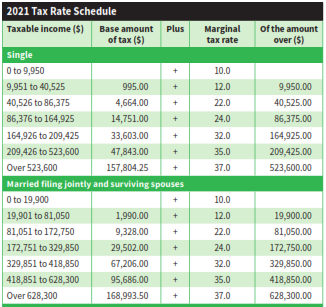

Not thinking about taxes. Many fail to realize that benefits can be taxable – and the thresholds are low – at ordinary income tax rates. Many would be wise to have withholding tax taken out of their benefits every month.

The tax-bracket trap: A widow’s tax bracket will likely change in the year after her husband’s death. Going from joint filing to single filing can provide the first shock. The second comes when their standard deduction has been cut in half.

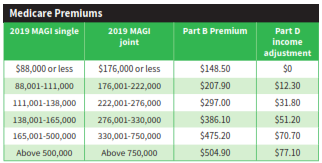

Getting blind-sided by Medicare. Believe it or not, Medicare has it’s own tax brackets. Besides having to pay Medicare Part B premiums, the move from a joint return to filing single means her Part B premiums could jump dramatically. This could be a big deal for widows, especially when added to all the other surprises.

Quarterly taxes? You read that correctly. How many widows, or retirees for that matter, don’t’ know how often they have to pay quarterly estimates on their income in retirement? Even if simply living off investment income, it’s still income. Failing to do so can result in penalties and interest. Not good.

Claiming early while planning to ‘bump-up’ the benefit later. Sorry. Once you’ve made a claim at age 62, you’re stuck. You can’t increase it later.

Widows often don’t realize one check is going away. Often women who are below age 60 with grown children think they can begin collecting benefits as soon as they become widows. The gap, however can be longer, not realizing they have to wait until age 60 to begin collecting benefits. Many also fail to realize that the spouses check will stop coming. The loss can be from 1/3 to 1/2, depending on her career earnings.

This isn’t an exhaustive list; there’s more to know. However, it should serve as a wake-up call that professional help could prove beneficial.

Jim