Business owners spend long hours for many years trying to build their dream. For many, their business represents 70%, 80%, even 90% of their net worth! It’s not unusual to have everything tied-up in their business ownership.

In essence, they have everything riding on one stock – something they’d never do with any other stock, even if the company was run by the greatest CEO on earth.

Their business is the source of their income, including salary and bonuses, as well as the source of all their benefits, including retirement funding and health insurance.

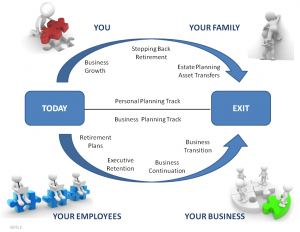

Business owners spend 110% of their energy on trying to grow their business; yet, if you ask them how they’ve planned their exit, you’ll often get a blank stare. Some say they plan to work ’til they drop; others say they’ll sell it, sure that it will be an attractive purchase.

How many will exit their business? Answer: 100% – either head first or feet first. Either way, how will the business be monetized?

Many don’t know what their business is worth.

I personally know one person who built a small but very successful restaurant chain that enjoyed excellent sales – until he unexpectedly (and rather quickly, unfortunately) contracted terminal cancer and died. The restaurants soon all went into receivership and were either liquidated or taken-over for pennies on the dollar – the family left with only his life insurance proceeds.

Many have no idea how they will exit.

It didn’t have to happen that way. He had key people in-place; but, he didn’t know how to plan business continuity. He also could have created a funding mechanism for his family to monetize all he’d worked for (in addition to his life insurance), but he hadn’t done that, either.

He, like many successful business owners running established businesses, didn’t even know what his business value, let alone have a mechanism in place to convert his asset into liquid dollars…. something he could have enjoyed even if he’d lived.

He probably didn’t want to spend the money on a formal appraisal; but, he didn’t have to do that, either – informal valuations for retirement and exit planning could have met his needs. [You can learn more about business valuation in our free report, which you can access here. If you would like a copy, we’ll also make sure you receive other relevant information from time to time.]

He probably didn’t want to spend the money on a formal appraisal; but, he didn’t have to do that, either – informal valuations for retirement and exit planning could have met his needs. [You can learn more about business valuation in our free report, which you can access here. If you would like a copy, we’ll also make sure you receive other relevant information from time to time.]

How about the business with multiple ownership? If/when something happens to one of them, do the others want to have the surviving spouse as a partner – maybe an equal partner – even though they may make little or no contribution to business success?

What if there’s a divorce? What if one simply decides to ‘hang it up’? What if one files for bankruptcy? Without the right mechanisms in place, the other owner(s) could be facing litigation or liquidation.

Many don’t know the solutions that are available.

He might have felt he didn’t want to siphon off dollars from cash flow that could be otherwise used to grow his businesses; but, there are mechanisms that can mitigate that concern, as well.

Successful owners of established businesses can be busy – often too busy to pay attention to the very issues they see as their ultimate objective in the first place.

I can empathize. Years ago I built a publishing business. Publishing weeklies combines the functions advertising, sales, production, manufacturing, distribution, credit and collections. Front to back, it entails virtually every business function you can think of, including deadlines and resource management.

I had a general manager named Nick who came up ‘through the ranks’ and became very capable at running the entire organization, allowing me to pursue other initiatives. I ended-up selling my businesses on the open market; but, had I known, I could have actually sold the whole thing to Nick – probably for more money even though he didn’t have much money. Simply by putting the right mechanisms in place early, I could have had a ready-made buyer in place… and one who not only knew the business, but knew the customers – and one that wouldn’t have made the bankers nervous.

Enjoy!

Jim

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.