A purely economic analysis seems to indicate this proposal does not seem to account for the financial consequences it could have on the Social Security Trust Fund; and other than a some feedback from the financial community, few seem to be engaging the discussion.

Social Security is the issue everyone wants to save; but some cures might cause even bigger problems. The elimination of this tax revenue stream is projected to accelerate the fund’s depletion by three years, expediting insolvency sooner than current projections suggest.

Despite these promises, the influence of Project 2025—a policy blueprint associated with conservative governance—on Trump’s Social Security policies remains uncertain. While Trump has publicly distanced himself from the initiative, many of his policies align with its recommendations. Notably, Project 2025 does not explicitly address Social Security, leaving uncertainty about how his administration will approach the program.

Impact on Social Security Administration Operations

One area that is expected to see significant change under the Trump administration is the operational efficiency of the Social Security Administration (SSA). The newly proposed Department of Government Efficiency (DOGE), spearheaded by Trump’s policy team, has identified SSA as a target for further cost-cutting measures. This is despite SSA’s reputation as one of the most efficiently managed government agencies.

Under the leadership of Commissioner Martin O’Malley, SSA made significant strides in improving efficiency. In 2024, productivity increased by 6.2%, even as the number of new beneficiaries surged. Despite these gains, SSA operates with its lowest staffing levels in 50 years. O’Malley implemented several improvements, including reducing average call wait times from 42 minutes to 12 minutes, streamlining procedures for overpayments and underpayments, and accelerating the processing of disability approvals.

Despite these advancements, Trump’s DOGE team has indicated plans to further scrutinize the agency’s operations, focusing on eliminating “waste, fraud, and abuse,” with an emphasis on ensuring that payments are directed only to rightful beneficiaries. The assertion is that these measures could save “hundreds of billions of dollars” without requiring changes to benefit formulas.

While these reforms are positioned as efficiency improvements, there is concern about their impact on service delivery. The departure of Commissioner O’Malley raises further uncertainty, as the President has nominated financial software executive and GOP donor Frank Bisignano to assume the role. Bisignano, known for his success in transforming large corporations, will be tasked with overseeing SSA’s continued commitment to service efficiency. However, there are concerns that further reductions in staffing and resources could result in longer wait times, increased errors in claims processing, and a decline in service quality.

The area most likely to experience disruptions is survivor benefits – something that requires manual processing rather than automated calculations. Any reductions in staffing or efficiency could lead to delays and complications for beneficiaries relying on these essential payments.

The Social Security Trust Fund and Fiscal Challenges

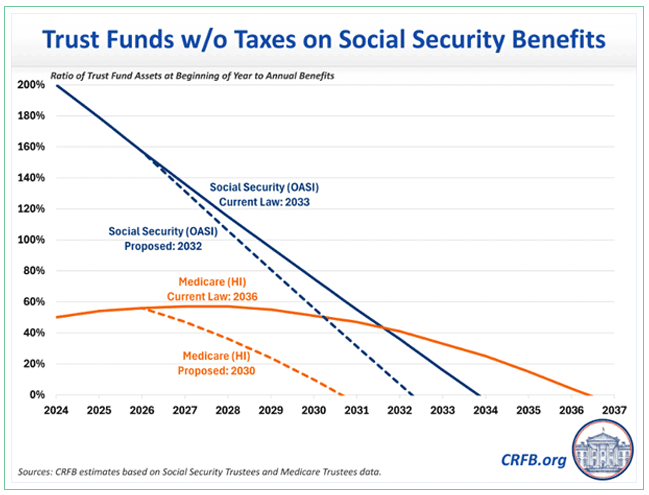

A major concern surrounding the President’s policies is the potential impact on the Social Security Trust Fund. An analysis by the Committee for a Responsible Federal Budget (CRFB) evaluated the implications of Trump’s proposals and found that they would significantly exacerbate Social Security’s financial shortfall.

According to the CRFB’s report, What Would the Trump Campaign Plans Mean for Social Security?, the following consequences could result from Trump’s proposals:

- Increase Social Security’s ten-year cash shortfall by $2.3 trillion through the fiscal year 2035.

- Advance the projected insolvency of the trust fund from 2034 to 2031, effectively reducing the timeline for corrective action by one-third.

- Lead to a 33% across-the-board benefit cut in 2035, up from the 23% cut projected under current law.

- Increase Social Security’s annual funding gap by approximately 50% in 2035, raising it from 3.6% to 4% of taxable payroll.

- Require either a one-third reduction in benefits or a 50% increase in revenue to restore 75-year solvency.

Trump’s Proposals and Their Fiscal Implications

While the administration has pledged not to touch benefits, it appears the economic consequences of other policies could lead to some ripple-effect unintended consequences.

Several specific policy proposals put forth by the administration could further weaken the financial stability of Social Security due to impacts seldom discussed:

- Eliminating Taxation of Social Security Benefits

- Currently, a portion of Social Security benefits are subject to taxation, and the revenue generated is used to help fund the program. Eliminating these taxes would remove a crucial funding source, accelerating the depletion of the trust fund.

- Ending Taxes on Overtime Pay and Tips

- Trump’s proposal to exempt overtime pay and tipped wages from taxation would reduce payroll tax revenue, further limiting contributions to Social Security and Medicare trust funds.

- Imposing Large Tariffs on Imports

- Tariff policies could lead to higher inflation, which would, in turn, increase the cost-of-living adjustments (COLAs) for Social Security beneficiaries. Higher inflation would put additional financial strain on the trust fund (surprise).

- Enhanced Border Security and Deportation of Unauthorized Immigrants

- The removal of undocumented workers would reduce the number of individuals paying into the Social Security system, decreasing payroll tax revenue and exacerbating the program’s financial challenges.

Effects on Medicare and Other Social Programs

The financial instability of Social Security would also have significant implications for Medicare, which is partially administered by SSA. A separate CRFB analysis, published in July, focused on the potential impact of eliminating taxes on Social Security benefits. The findings indicated that this policy alone would accelerate the insolvency of Medicare’s Hospital Insurance (HI) Trust Fund by six years.

Given that Medicare and Social Security serve overlapping beneficiary populations, any financial strain on one program is likely to have cascading effects on the other. Increased pressure on these programs could lead to reductions in services, increased premiums, or policy changes that shift more costs onto beneficiaries.

Conclusion

While President-elect Trump has pledged not to cut Social Security benefits, his proposed policies could have significant long-term consequences for the program’s financial stability. The elimination of taxation on Social Security benefits, changes to payroll tax structures, and other proposed economic measures could hasten the insolvency of the Social Security Trust Fund, leading to substantial benefit cuts in the future, despite how good they sound.

The operational efficiency of SSA is another area of concern. Despite notable improvements under Commissioner O’Malley, the Trump administration’s plans to further streamline the agency could negatively impact customer service, leading to longer wait times and increased administrative challenges—particularly for individuals applying for survivor benefits.

As policymakers and beneficiaries alike evaluate the future of Social Security under the Trump administration, it is essential to consider both the short-term benefits of proposed tax cuts and the long-term sustainability of the program. Ensuring the financial health of Social Security will require a balanced approach that safeguards the needs of current and future beneficiaries while addressing funding challenges through responsible fiscal policy.

Did I say ‘responsible fiscal policy’? Wouldn’t that be a nice change…..

Jim