But, as we began to see an aging population, more people retiring, and a lesser percentage of population paying in, a source of revenue became necessary to preserve benefits for both current and future retirees. It was part of tax reform in 1986, hammered out by both parties, led by President Reagan and House Speaker “Tip” O’Neil. They created a framework for taxing ‘provisional income’. But (here it comes) those brackets weren’t indexed for inflation. Bingo. Inflation carried more people into those brackets as the years went by without either party having to raise taxes.

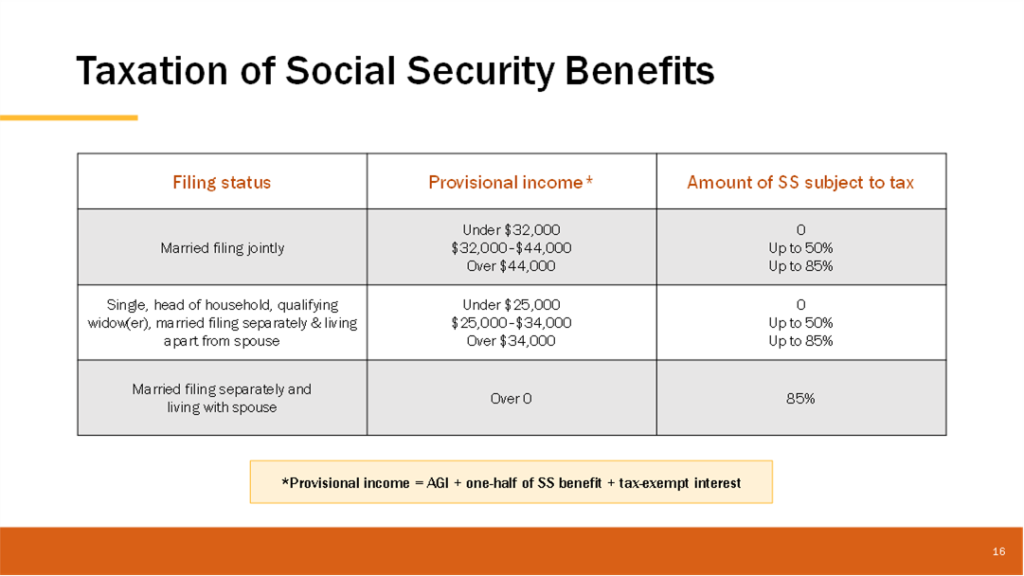

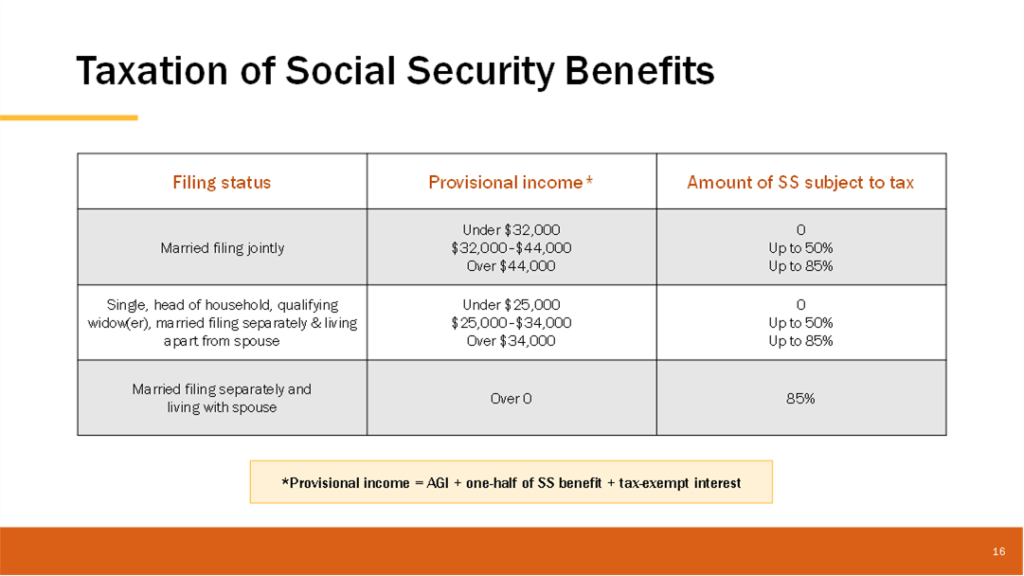

What is ‘Provisional Income”? It includes adjusted gross income, plus one-half of the Social Security benefit plus any tax-exempt interest. So, the brackets apply to 1/2 of the Social Security benefits received. Did you notice that even tax-free municipal bond interest is included for this computation? Let’s take a look at the brackets.

As you can see, it doesn’t take much for a married couple to see their Social Security benefits get taxed. A married couple filing jointly and with only $75,000 in provisional income will see at 85% of their benefit included in taxable income.

What if their were no taxes on benefits? According to the Committee for a Responsible Federal Budget (CRFB), it would increase Social Security’s 10-year cash shortfall by $2.3 trillion through FY 2035, and advance insolvency by three years from FY 2034 to FY 2031. The across-the-board benefit reductiions in 2035 would go from 23% to 33%, according to the Congressional Budget Office (CBO). There’s more, but you get the idea: no free lunch. It basically eliminates a revenue stream now being used to fund current benefits, which puts stress on the trust fund.

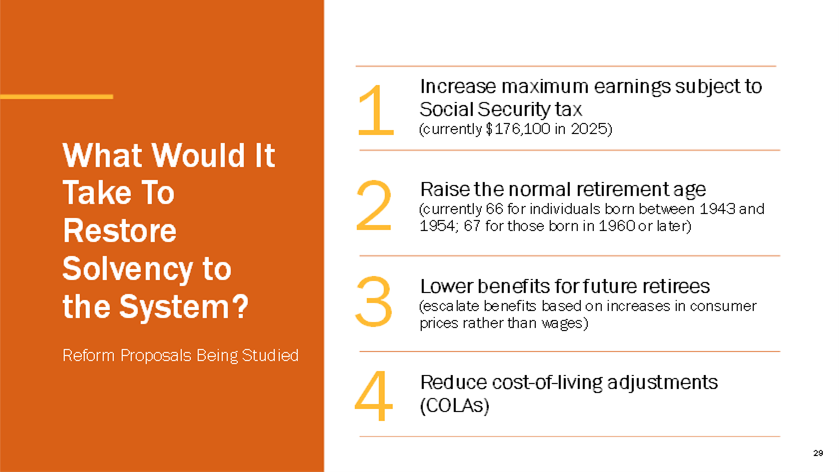

What can Congress do to save Social Security? It’s simple math, really. There are reform proposals now circulating on Capitol Hill. The answer to come from any one or a combination of these options:

#1 may be the easiest to get passed.

#2 may be more difficult since working in a coal mine is different than working in an office.

#3 may not be required if #1 is adequately adjusted.

#4 may not be required for the same reason. They also could adjust provisional brackets.

We’ll see what congress does; but, as for taxes, be careful what you wish for.

Jim