When I first entered this business back in 1990, most people were watching financial tv shows – virtually all of which were covering mutual funds in those days. It seemed everyone wanted to buy mutual funds!

In a way, it made sense. In those days, the large baby-boom demographic bubble was largely made-up of people who were accumulating and in their peak earning years. Now, however, the story is different.

Growth with some risk seemed okay. Retirement was still a long ways off. But, today, the story has changed. Baby-boomers are getting closer to retirement and other issues are more important: Security and predictability.

If those issues are important to you, you may enjoy readingourIFGi_Report_Let’s Reviewthat may help put things in perspective for you. Enjoy!

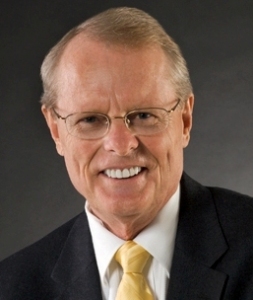

Jim

———————-

Become an IFG client! Don’t play phone-tag; schedule your 15-minute introductory phone call using this convenient scheduler!

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a fee-only registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. IFG helps specializes in crafting wealth design strategies around life goals by using a proven planning process coupled with a cost-conscious objective and non-conflicted risk management philosophy.

The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.