So, what are some of the things we should be doing at different ages?

Let’s take a look at some of the things we should be thinking about as we move past age 50:

Ages 50-60

Final Preparation and Risk Management

- Refine Retirement Budget: Develop a detailed retirement budget that includes anticipated living expenses, healthcare costs, and discretionary spending. Even companies like Microsoft operate with budgets; why shouldn’t you?

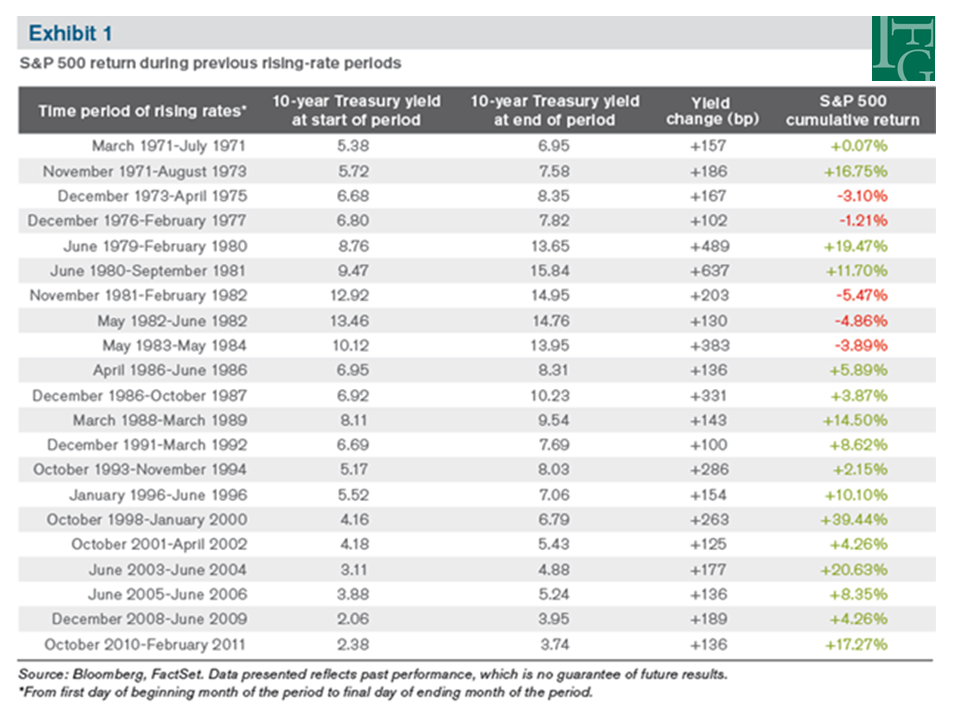

- Adjust Investment Strategy: It’s a common practice to shift investment strategy to become more conservative as retirement approaches. The idea is that it helps protect accumulated savings from market volatility. However, you still may have thirty more years of inflation and tax law changes ahead of you. A billionaire like Warren Buffett may have 95% of his money in stocks while someone on welfare can’t do that. What you should do should be dictated by a lot of factors all integrated into your own personal financial plan. Don’t get sucked-in to a blanket target-date fund – they’re nothing but balanced funds that change allocations over time – not all people the same age are alike, have the same financial assets or experience the same circumstances.

- Maximize Social Security Benefits: Plan when to start taking Social Security benefits. Delaying benefits can result in higher monthly payments. Here, a financial plan that incorporates your future Social Security strategy can be worth hundreds of thousands of dollars.

- Explore Healthcare Options: Research healthcare options, including Medicare and supplemental insurance, to ensure adequate coverage in retirement.

- Downsize if Necessary: Consider downsizing to a smaller home or relocating to reduce living expenses and free up additional funds for retirement.

Pre-Retirement: Ages 60-65

Transition and Final Adjustments

- Finalize Retirement Date: Determine your exact retirement date and inform the employer. Ensure all necessary paperwork and benefits are in order.

- Create a Withdrawal Strategy: Talk with your financial advisor. It’s not as simple as just withdrawing funds from retirement accounts. Consider tax implications and required minimum distributions (RMDs). The size of your future RMDs will impact taxation on your Social Security benefits and the size of your Medicare premiums.

- Review Estate Plan: Yes, Virginia, you don’t have to be rich to have an estate plan. In fact, EVERYONE already has one! That’s right. The problem is, of course, is if people don’t create their own, the government has a default estate plan already in-place for them – and it can be expensive and time consuming. Better to update estate planning documents such as wills, trusts, and power of attorney to reflect current wishes. Talk with your attorney or get guidance from your financial advisor on how to access the right help.

- Evaluate Income Sources: Assess all potential sources of retirement income, including pensions, annuities, and rental properties. Naturally, these are all components of your financial plan.

- Conduct a Retirement Trial Run: Try living on the projected retirement budget for a few months to identify any adjustments that may be needed.

Retirement: Ages 65 and Beyond

Enjoy Retirement and Stay Financially Healthy

- Monitor Spending and Investments: Regularly review spending and adjust the budget as needed. Monitor investment performance and make necessary adjustments to ensure funds last throughout retirement.

- Stay Informed About Benefits: Keep up-to-date with changes in Social Security, Medicare, and other benefits.

- Consider Part-Time Work: Some individuals may choose to work part-time or engage in freelance work to supplement retirement income.

- Stay Active and Engaged: Maintain an active lifestyle and stay socially engaged to enhance overall well-being in retirement.

Want more information?

Retirement planning is a multi-stage process that requires careful consideration and regular adjustments. Here are a couple of tools to help you:

Important Milestones: Dates you need to know

Retirement Issues: A 2-page retirement checklist covering areas like cash flow, healthcare and insurance, assets & debt, tax planning, long-term care and other issues.

Enjoy!

Jim