Five Times When An Annuity Makes Sense

My recent blog posts, as well as on this platform, discussed the advantages of arranging assets early – ten years or more before retirement

My recent blog posts, as well as on this platform, discussed the advantages of arranging assets early – ten years or more before retirement

Last week we heard from many experts who believe it may be time to dump the 401(k). Two weeks ago we discovered that many experts,

Jim Lorenzen, CFP®, AIF® When most people think about estate planning, they think about protecting assets from estate taxation. But, most people aren’t worried about

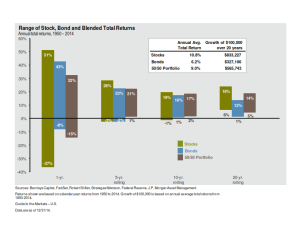

You’ve seen this chart. Advisors have been using it – or something like it – with clients and prospective clients for years. It’s supposed to

Jim Lorenzen, CFP®, AIF® First, let me state up-front that I AM a big believer in the power of life insurance, especially when designed as

James Lorenzen, CFP®, AIF® This was sent to us by one of my wife’s friends; I thought you might enjoy it. To commemorate her 79th

When I grew up – I was an only child – there was my mom, my dad, and me. When I graduated from college, I

When I first entered this business back in 1990, most people were watching financial tv shows – virtually all of which were covering mutual funds

We’ve seen it all our lives; and the older one gets, the more transparent it becomes. Some people simply don’t know what they’re talking about.

Here’s IFG’s March 2015 Viewpoint and Outlook. It should serve as a “heads up” for those of you over age 50, for whom retirement planning

During his campaign, President Donald Trump pledged not to reduce Social Security benefits. He even proposed eliminating taxation on Social Security benefits, which would enable higher-income beneficiaries to retain more of their income.

Rise of avocados is a powerful lesson in understanding how markets evolve