Big Changes in Social Security Claiming

Jim Lorenzen, CFP®, AIF® The Bipartisan Budget Act of 2015, passed by Congress and signed into law by President Obama on October 30, 2015, will

Jim Lorenzen, CFP®, AIF® The Bipartisan Budget Act of 2015, passed by Congress and signed into law by President Obama on October 30, 2015, will

Jim Lorenzen, CFP®, AIF® I think many, if not most, professional advisors would agree that even 99% of”the affluent” make the same mistakes made by

Jim Lorenzen, CFP®, AIF® Is your income common or uncommon? Most of us think our income is pretty normal, according to most of the studies

Jim Lorenzen, CFP®, AIF® While historic inflation rates average a bit over 4% and many people doing their own calculations may be using figures in

Jim Lorenzen, CFP®, AIF® I can speak from personal experience on this one. I’ve been a business owner for thirty-seven years, owning seven different businesses

Jim Lorenzen, CFP®, AIF® Don’t believe beautiful illustrations. They’re based on assumptions that can change. Unless you know the probability of success in advance –

Jim Lorenzen, CFP®, AIF® Sound familiar? If so, it’s because you saw all those television commercials selling safety to a frightened public. After all, all

What to do with your money in an employer-sponsored retirement plan, such as a 401(k) plan? Since these funds were originally intended to help provide

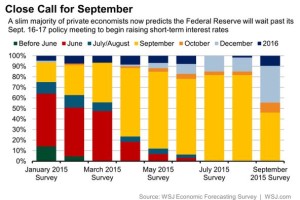

A slim majority of economists don’t believe they will. We’ll soon see if these ‘experts’ are right.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.