Business Valuation Matters

Jim Lorenzen, CFP®, AIF® Business valuation matters! And, not just when you plan to sell. Few business owners realize that valuation ‘what-if’s’ can help determine

Jim Lorenzen, CFP®, AIF® Business valuation matters! And, not just when you plan to sell. Few business owners realize that valuation ‘what-if’s’ can help determine

Jim Lorenzen, CFP®, AIF® When you receive business sale proceeds, you’ll likely pay a capital gains tax; but, that may not be the end

Jim Lorenzen, CFP®, AIF® 1954 1986 2017 What do those years have in common? If you guessed those were the years of major tax reform,

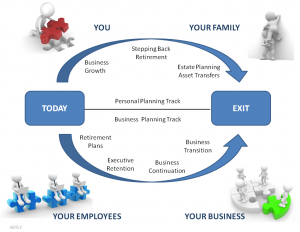

Jim Lorenzen, CFP®, AIF® Business owners spend long hours for many years trying to build their dream. For many, their business represents 70%, 80%, even

Jim Lorenzen, CFP®, AIF® First I want to point out that this post is really courtesy of Senior Deputy Becky Purnell of the Moorpark Police

Jim Lorenzen, CFP®, AIF® People often think investment strategies for retirement security involve a either/or choices, i.e, risky stocks or savings as a zero-sum choice,

Jim Lorenzen, CFP®, AIF® An income for life – a lifetime retirement income strategy is whatmost people want – but are they willing to do

Jim Lorenzen, CFP®, AIF® Last week I asked which was most important to you: Never running out of money Never running out of income Whether

Jim Lorenzen, CFP®, AIF® Which goal is most important to you? – Never running out of retirement money – Never running out of retirement income

Jim Lorenzen, CFP®, AIF® In a previous post I talked about how everyone now has to be his/her own actuary, if they want to create

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.