Yes, when it comes to inherited IRAs, non-spouse beneficiaries – usually children – face a very different set of rules than spouses. Yes, IRA beneficiary rules for children ARE different.

Navigating these rules incorrectly—especially when moving inherited retirement assets—can result in the permanent loss of tax-deferred status and an unexpected tax bill. Ouch.

Why It Matters: The High Cost of Mistakes

Non-spouse beneficiaries who move inherited IRAs using improper methods risk turning what should be a tax-deferred transfer into a fully taxable event. This is more than a paperwork error—it’s a potentially irreversible mistake that accelerates taxable income and undermines long-term financial planning.

Note: While this article uses the term “IRA” throughout, the rules also apply to inherited employer-sponsored retirement plans, such as 401(k)s and 403(b)s.

Who Qualifies as a Non-Spouse Beneficiary?

Under the IRS Final RMD (Required Minimum Distribution) Regulations, a non-spouse beneficiary is any “designated beneficiary who is not a spouse.” There are three key classifications:

1. Designated Beneficiary

This includes individuals named as beneficiaries and certain see-through trusts (trusts that meet specific IRS requirements). Legal counsel is essential to determine whether a trust qualifies.

2. Eligible Designated Beneficiary

These are designated beneficiaries who meet one of the following criteria at the time of the IRA owner’s death:

- Surviving minor child of the IRA owner

- Disabled or chronically ill individual

- Individual not more than 10 years younger than the IRA owner

Spouses are treated under a separate set of rules and are not covered in this discussion.

3. Non-Designated Beneficiary

Entities such as estates, charities, and non-qualifying trusts fall into this category. Their distribution rules are less favorable and more rigid.

Note: A beneficiary can be designated and still be ineligible for the stretch – and that’s where most non-spouse beneficiaries (children) are. You might find this video helpful.

🔑 Key Date to Remember: Beneficiary classification is finalized on September 30 of the year following the IRA owner’s death—especially important when multiple beneficiaries are involved.

Portability Options: Transfers vs. Rollovers

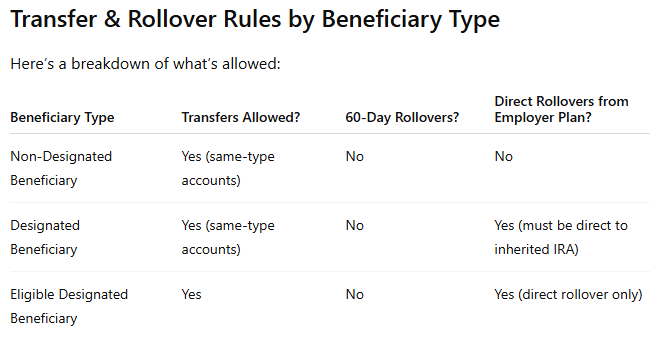

Non-spouse beneficiaries must understand the correct way to move inherited assets. There are three key portability methods:

✅ Trustee-to-Trustee Transfers (Nonreportable)

- Tax-free and nonreportable

- Must be between same-type accounts (e.g., inherited traditional IRA to inherited traditional IRA)

- Beneficiary name and relationship must remain consistent

❌ 60-Day Rollovers (Not Allowed for Inherited IRAs)

- Non-spouse beneficiaries are not permitted to use 60-day rollovers

- Doing so will result in a fully taxable distribution

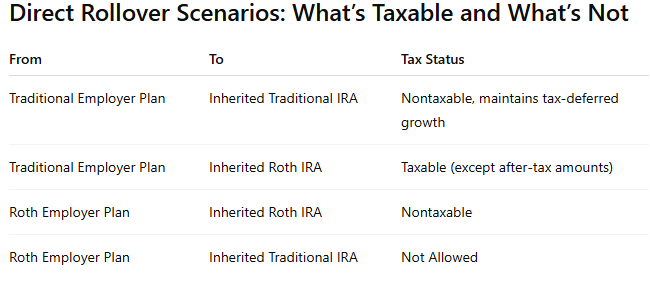

✅ Direct Rollovers (From Employer Plans Only)

- Permitted only from inherited employer-sponsored retirement plans

- Must be directed to a properly titled inherited IRA

- Reportable, but tax-deferred if staying within same account type (traditional to traditional, Roth to Roth)

Transfer & Rollover Rules by Beneficiary Type

⚠️ Important: The receiving and delivering accounts must always be beneficiary accounts titled in the name of the deceased and the beneficiary (e.g., Jane Smith IRA FBO Carol Smith, Beneficiary).

Direct Rollover Scenarios: What’s Taxable and What’s Not

📌 Reminder: All RMDs must be taken before executing a direct rollover to avoid compliance penalties. For more details, see our post: Avoid RMD Shortfalls on Inherited IRAs: 5 Top Life Expectancy Rules.

Avoiding Common Pitfalls

One of the most frequent (and costly) errors is attempting a rollover that is not permitted—such as trying to use a 60-day rollover from an inherited IRA. This misstep not only triggers full taxation but can eliminate the ability to spread distributions over a 10-year period under the SECURE Act’s rules.

For example, a designated beneficiary under the 10-year rule who mistakenly performs a rollover may be required to recognize the entire distributed amount as income in the year of the distribution.

Final Thought: Consult an Expert

Inherited IRA rules for non-spouse beneficiaries are complex and unforgiving. Working with a qualified financial advisor or tax professional is essential to:

- Identify the correct type of beneficiary classification

- Choose the appropriate method of transfer or rollover

- Maintain tax-deferred growth and minimize tax liability

When in doubt, ask before you act—because when it comes to inherited retirement accounts, the cost of getting it wrong is high. Knowing about the SECURE Act 2.0 would be helpful, too.

It’s a maze of rules, I know. Would you like an easy-to-follow roadmap you can use? We have a flowchart summarizing the options for a non-spouse IRA beneficiary. Just tell me where to send it!

Enjoy!

Jim

Would you like to get started with your planning? Here’s where to start!