Let’s start with a brain teaser:

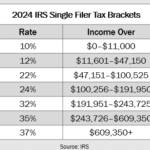

• Bill is retired and has taxable income of $48,988 this currently puts him at the l ow end of the 22% tax bracket.

ow end of the 22% tax bracket.

• Includes $40,000 in IRA income

• Plus $37,500 in Social Security benefits

• He taps his IRA for an extra $1,000 – he wants to go on a road trip to see Pee Wee Herman in concert.

You’d think that $1,000 from his IRA would increase his income by only $1,000 and he’d stay in the 22% tax bracket. Tax on the withdrawal would be $220, right?

Nope. The tax on that $1,000 withdrawal would come to $407! – a 40.7% tax rate! He didn’t see a tax trap.

How did this happen? Stay tuned…. you’ll see. (or, if you can’t wait, subscribe to my newsletter and see the video here! If you subscribe, don’t worry, you can unsubscribe instantly at any time).

Let’s first begin by breaking down five sneaky tax traps that could trip you up—and what you might be able to do about them before it’s too late.

1. Required Minimum Distributions (RMDs): The IRS Wants Its Cut, Like Clockwork

Once you hit age 73 (or 75, depending on your birth year), the IRS forces you to start taking money out of your retirement account whether you need it or not. These Required Minimum Distributions (RMDs) are calculated based on your account size and your age, and they only grow over time.

At 73, you might have to take out around 4% of your account. By 85, it’s over 6%. Add that to your Social Security income, and suddenly you’re in a higher tax bracket than expected—possibly paying more in taxes than you did while working full-time!

What to do: Start planning your withdrawals before you turn 70. A good tax strategy now can save you big later.

2. Tax Cuts and Jobs Act (TCJA) Is on the Chopping Block

The 2017 TCJA brought historically low tax rates—and those rates are scheduled to expire at the end of 2025. If Congress doesn’t step in, tax brackets will go up, and estate tax exemptions will shrink dramatically.

Let’s say you and your spouse earn $300,000. Right now, you’re taxed at 24%. After 2025? That jumps to 33%. Ouch.

What to do: Stay on top of legislation, and position your income and estate wisely. Tax-smart moves now (like Roth conversions or charitable giving strategies) could be lifesavers later.

3. The Widow Penalty: Losing a Spouse Can Raise Your Taxes

Here’s a curveball most people don’t see coming: once a spouse passes away, the survivor typically files taxes as “single” instead of “married filing jointly.” That switch can push the surviving spouse into a higher tax bracket—despite having nearly the same income.

And it’s not just income taxes. Medicare IRMAA surcharges (extra premiums for higher-income earners) can also spike, just because one spouse is gone.

What to do: Consider strategies like Roth conversions while both spouses are still alive and in a lower joint bracket. And make sure your estate plan anticipates this unfortunate tax twist.

4. Leaving a Big IRA to the Kids Isn’t as Sweet as It Sounds

Thanks to the SECURE Act (passed in 2019), your kids can no longer stretch out IRA withdrawals over their lifetimes. Now they have just 10 years to empty the account—and starting in 2025, most will have to take annual RMDs during that 10-year window too.

If your kids are in their peak earning years, this inheritance could push them into much higher tax brackets. So instead of your legacy being a gift, it might feel like a tax trap.

What to do: Spend down your traditional IRA gradually, or consider converting to a Roth IRA while your rates are low. Trusts, charitable planning, and other legacy strategies can also help.

5. Estate Planning: The Rules Are Changing, Fast

Estate tax law is like fashion—trends change quickly and not always for the better. The current estate tax exemption ($13.99 million per person) is generous, but it’s set to get cut in half after 2025 unless Congress acts.

Meanwhile, popular estate planning tactics are under attack. And if your total assets are around $6 million or more, the risk of your estate facing a hefty tax bill is real.

What to do: Get proactive. Talk to an estate planning expert now. Build flexibility into your plan. And don’t wait until Congress makes a move—by then, your options could be gone.

Taxes in Retirement Aren’t Just a Nuisance—They’re a Strategy Game

You’ve spent your life earning, saving, and building wealth. Don’t let retirement taxes turn your victory lap into a detour. With smart planning and timely advice, you can keep more of your hard-earned money—and leave a better legacy for the people you love.

Pro tip: Always check with a qualified tax pro before making big moves. The IRS doesn’t play favorites.

These aren’t the only tax traps! The distribution phase of retirement is very different from the accumulation phase. Accumulation was just saving as much as you could and everyone recommended tax-deferred (tax delayed) vehicles. Decumulation isn’t so simple. Tax planning changes through the four phases of retirement! And, you need to know how that happens!

Okay, back to our brain-teaser!

How did Bill’s $1,000 IRA withdrawal cause him to pay $407 in taxes? The spending phase (decumulation) is different from the accumulation phase. Those days were simpler: You worked, saved, and grew your money. Not so simple now, as Bill soon learns.

And, you may be surprised to learn how tax planning changes throughout retirement – and just how many tax traps there are!

Grab some coffee! You’ll not only learn the answer to our brain teaser – you’ll also learn about more tax traps in How Tax Planning Changes during the Four Stages of Retirement! Get started here!

Enjoy!

Jim

Here are some additional retirement resources you may like:

My retirement planning page: https://indfin.com/retirementplanning/

A paper on Understanding Diversification: https://indfin.com/wp-content/uploads/2014/09/i306_Understanding-The-Diversification-Puzzle.pdf