How To Avoid the Family Business Wealth Evaporation Trap

Jim Lorenzen, CFP®, AIF® Family business owners face wealth evaporation daily. It’s like glaucoma. You can’t tell it’s happening on a daily basis, but the

Jim Lorenzen, CFP®, AIF® Family business owners face wealth evaporation daily. It’s like glaucoma. You can’t tell it’s happening on a daily basis, but the

Jim Lorenzen, CFP®, AIF® Managing retirement income has never been easy. Those who retired in the early 1970s saw interest rates rise dramatically, then fall

Jim Lorenzen, CFP®, AIF® Business valuation matters! And, not just when you plan to sell. Few business owners realize that valuation ‘what-if’s’ can help determine

Jim Lorenzen, CFP®, AIF® When you receive business sale proceeds, you’ll likely pay a capital gains tax; but, that may not be the end

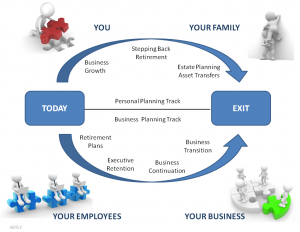

Jim Lorenzen, CFP®, AIF® Business owners spend long hours for many years trying to build their dream. For many, their business represents 70%, 80%, even

Jim Lorenzen, CFP®, AIF® People often think investment strategies for retirement security involve a either/or choices, i.e, risky stocks or savings as a zero-sum choice,

Jim Lorenzen, CFP®, AIF® An income for life – a lifetime retirement income strategy is whatmost people want – but are they willing to do

Jim Lorenzen, CFP®, AIF® Last week I asked which was most important to you: Never running out of money Never running out of income Whether

Jim Lorenzen, CFP®, AIF® Which goal is most important to you? – Never running out of retirement money – Never running out of retirement income

Jim Lorenzen, CFP®, AIF® In a previous post I talked about how everyone now has to be his/her own actuary, if they want to create

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.