ZIRP ended in 2022. Now, the Fed’s balance sheet is at $7 trillion – $6 trillion more than the $1 trillion historical average.

If interest rates rise, it could lead to a ‘debt spiral’ – servicing the interest on our $36 trillion dollar debt (which is constantly rising) by “monetizing” – which means borrowing even more.

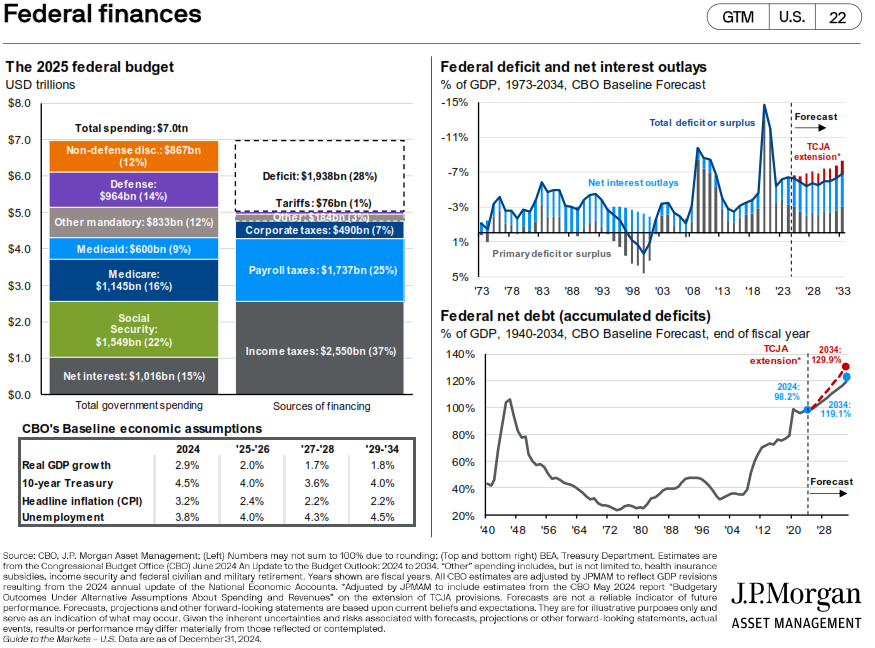

Interest payments are already our government’s third highest expense – even higher than defense. And, if interest rates rise above 5%, interest on the debt will become the government’s single largest expense.

Inflation complicates things. No surprise. Politician’s promises seem to always come with price tags, while most of the talk about reorganization will face problems on Capitol Hill – every expenditure has a constituency and they are, after all, in the re-election business.

Be careful what you wish for.

Jim