Business Valuation Matters

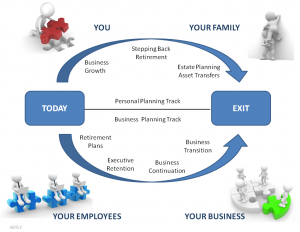

Jim Lorenzen, CFP®, AIF® Business valuation matters! And, not just when you plan to sell. Few business owners realize that valuation ‘what-if’s’ can help determine

Jim Lorenzen, CFP®, AIF® Business valuation matters! And, not just when you plan to sell. Few business owners realize that valuation ‘what-if’s’ can help determine

Jim Lorenzen, CFP®, AIF® Business owners spend long hours for many years trying to build their dream. For many, their business represents 70%, 80%, even

Jim Lorenzen, CFP®, AIF® Successful business owners know they’re successful because of their people. Within that group there’s usually one or two key people that

Jim Lorenzen, CFP®, AIF® Did you know that as much as 80% to 90% of many business owner’s net worth is tied-up in their businesses?

Jim Lorenzen, CFP®, AIF® No, that’s no my picture – I wish I were that young and good looking; but he does look like a

Jim Lorenzen, CFP®, AIF® Ever heard of a “One-Way Buy-Sell” arrangement? Don’t feel bad. Few people have. I know when I was in publishing I

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.