How Social Security and Pensions Might Impact How You Arrange Your Nest-Egg.

If you’re receiving Social Security, Pension, or other guaranteed income, you may want to rethink how your nest-egg is arranged for long-term inflation risk.

If you’re receiving Social Security, Pension, or other guaranteed income, you may want to rethink how your nest-egg is arranged for long-term inflation risk.

Increased debt, the worry of a debt spiral, low yields, and future taxes – all make a solid plan more important than ever. Unfortunately, too many put it off until the’re “confident’, but they never get there.

This major change will bring in $15.7 billion in tax revenue by 2029, according to the joint committee on taxation in their report on the bill, H.R. 1994. And, guess whose money they want? Yes, yours.

The SECURE Act has changed the game, especially for parents who were planning on leaving substantial nest-eggs to their kids, with the elimination of Stretch IRAs. Uncle Sam may be the biggest beneficiary.

Giving to charity doesn’t have to mean your kids get less. You might be able to make everyone happy… except Uncle Sam.

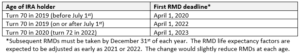

The SECURE Act contains quite a few changes that impact both individuals and business owners.

Typically, small business owners are the active managers of their businesses, are heavily invested in their businesses, and generally rely on a small number of important accounts and suppliers. Also, in most, if not all, cases no secondary market exists for easy valuation and quick disposition of ownership.

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.