LOOK FOR LOWER PAYOUTS ON GUARANTEED INSURANCE LIFETIME PAYOUTS

Jim Lorenzen, CFP®, AIF® Virtually all insurance companies will be using the newer 2012 mortality tables in 2016. Why is that important? The answer is

Jim Lorenzen, CFP®, AIF® Virtually all insurance companies will be using the newer 2012 mortality tables in 2016. Why is that important? The answer is

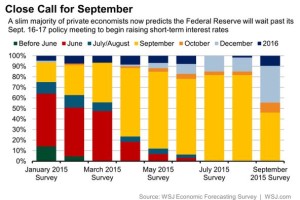

A slim majority of economists don’t believe they will. We’ll soon see if these ‘experts’ are right.

Rising interest rates can have an effect on bond values. After all, if you’re holding a bond paying 2% and interest rates for comparable bonds

Jim Lorenzen, CFP®, AIF® Steven Elwell, a CFP® practitioner in Amherst, NY recently wrote a nice piece for NerdWallet on this subject. In his piece,

Jim Lorenzen, CFP®, AIF® One of my hobbies, if you can call it that, is American history – particularly the period between 1765 and 1800.

Jim Lorenzen, CFP®, AIF® For some, managing a large inheritance can be as daunting as winning the lottery; the windfall may sound good initially, but

Last week we heard from many experts who believe it may be time to dump the 401(k). Two weeks ago we discovered that many experts,

James Lorenzen, CFP®, AIF® This was sent to us by one of my wife’s friends; I thought you might enjoy it. To commemorate her 79th

When I first entered this business back in 1990, most people were watching financial tv shows – virtually all of which were covering mutual funds

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.