Roth Conversions Can Be Advantageous, but Not for Everyone.

There may be times when a Roth conversion may be advantageous; but there are others when it may not be your best move.

There may be times when a Roth conversion may be advantageous; but there are others when it may not be your best move.

Social Security can be confusing; even the hard-working people working in Social Security offices don’t always get it right. Here are the two questions advisors often get asked.

Social Security claiming mistakes can result in more than just lost income; you might end-up paying thousands in extra taxes later!

Longevity risk is real. Accumulating assets for retirement was a lot easier than managing retirement income. Now you practically have to be an actuary to make sure your money doesn’t run out before you do!

Longevity risk is real. Accumulating assets for retirement was a lot easier than managing retirement income. Now you practically have to be an actuary to make sure your money doesn’t run out before you do!

A Roth conversion for some IRA assets may provide more tax savings than you realize.

Over half of all Americans expect to live a comfortable retirement and only one third think Social Security will be important to them.

The Social Security Board of Trustees released its annual report on the long-term financial status of the Social Security Trust Funds.

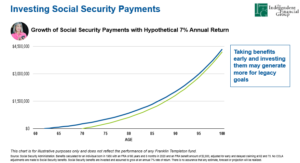

There may be times when you might decide it’s worth claiming your Social Security benefits early!

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.