Do You Know the 5 Biggest Risks To Your Retirement?

Jim Lorenzen, CFP®, AIF® Do you know what your biggest retirement risks are? Many might think, after watching all the coverage about Greece, computer glitches

Jim Lorenzen, CFP®, AIF® Do you know what your biggest retirement risks are? Many might think, after watching all the coverage about Greece, computer glitches

Jim Lorenzen, CFP®, AIF® Steven Elwell, a CFP® practitioner in Amherst, NY recently wrote a nice piece for NerdWallet on this subject. In his

Jim Lorenzen, CFP®, AIF® More and more boomers are beginning to approach retirement. No news there; but something’s been happening – and continues to

Jim Lorenzen, CFP®, AIF® When I first entered the advisory business in the early 1990s, financial entertainment television was a new phenomenon. All the tv

My recent blog posts, as well as on this platform, discussed the advantages of arranging assets early – ten years or more before retirement

Last week we heard from many experts who believe it may be time to dump the 401(k). Two weeks ago we discovered that many experts,

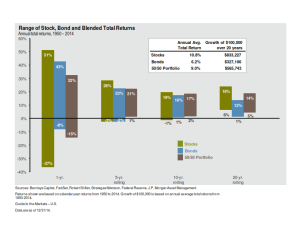

You’ve seen this chart. Advisors have been using it – or something like it – with clients and prospective clients for years. It’s supposed to

If you have $500,000 in your 401(k) or IRA, it’s not really $500.000. That’s a tax planning mistake most people make going right out of the gate. If you’re married and filing jointly, it’s more likely you could have $325,000 (35% tax bracket) or just $315,000 (37% tax bracket).

The three largest expenses in the federal budget are Social Security/Medicare, interest on the debt, and defense.