Did You Know the Government Subsidizes Market Losses in Traditional IRA and 401K accounts?

True! Market losses aren’t all yours. The IRS subsidizes part of them.

True! Market losses aren’t all yours. The IRS subsidizes part of them.

For some people, planning for retirement can feel like trying to eat an elephant; but, it doesn’t have to be that way. Before making big decisions, it’s always important to get the ducks lined-up first.

Good question. Whether or not you should roll-over your retirement funds to an IRA….. it depends (#1 in the consultant’s handbook of responses).

Looking for retirement security?

Government spending has been out of control for decades and Congress needs to raise revenue. So, they passed The SECURE (Setting Every Community Up for Retirement Enhancement) Act in December 2019. It may secure the government’s future; but, one provision may make your heir’s retirement a little less secure.

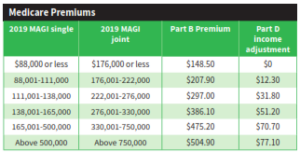

Expecting a big capital gains or other tax event this year? It might mean an unexpected tax surprise that can affect your Medicare premiums two years from now!

Tax traps are waiting. Did you it’s possible to be smack in the middle of the 22% tax bracket, yet taking an additional $1,000 in income could make that additional money taxable at 40%? It can happen to some taxpayers. In fact, there are other pitfalls many aren’t aware of, as well.

There may be times when a Roth conversion may be advantageous; but there are others when it may not be your best move.

Longevity risk is real. Accumulating assets for retirement was a lot easier than managing retirement income. Now you practically have to be an actuary to make sure your money doesn’t run out before you do!

Longevity risk is real. Accumulating assets for retirement was a lot easier than managing retirement income. Now you practically have to be an actuary to make sure your money doesn’t run out before you do!

A Roth conversion for some IRA assets may provide more tax savings than you realize.

Whether you live locally in Moorpark, Simi Valley, or anywhere else, you may want to consider having a trusted fiduciary financial advisor help with your mid-year review, as you may see.

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.