Business owners aren’t all alike. Neither are financial advisors.

Unlike many financial advisors or many other CERTIFIED FINANCIAL PLANNER® professionals , I’ve actually owned businesses; not just one, but several outside the financial profession – and all going full-cycle from founding to exit. I know what it’s like to work with suppliers, employees, and customers – and what it’s like to make a payroll.

My businesses were in publishing weekly papers and shoppers – a business that combines the elements of a service business with those of manufacturing and distribution – so, I can relate to the central issues business owners face every day.

Business owners live in a world a bit different from everyone else.

While most people work at their careers and need to budget their spending and saving to navigate a path to a successful retirement, business owners must deal with a myriad of additional complex financial decisions not required of others.

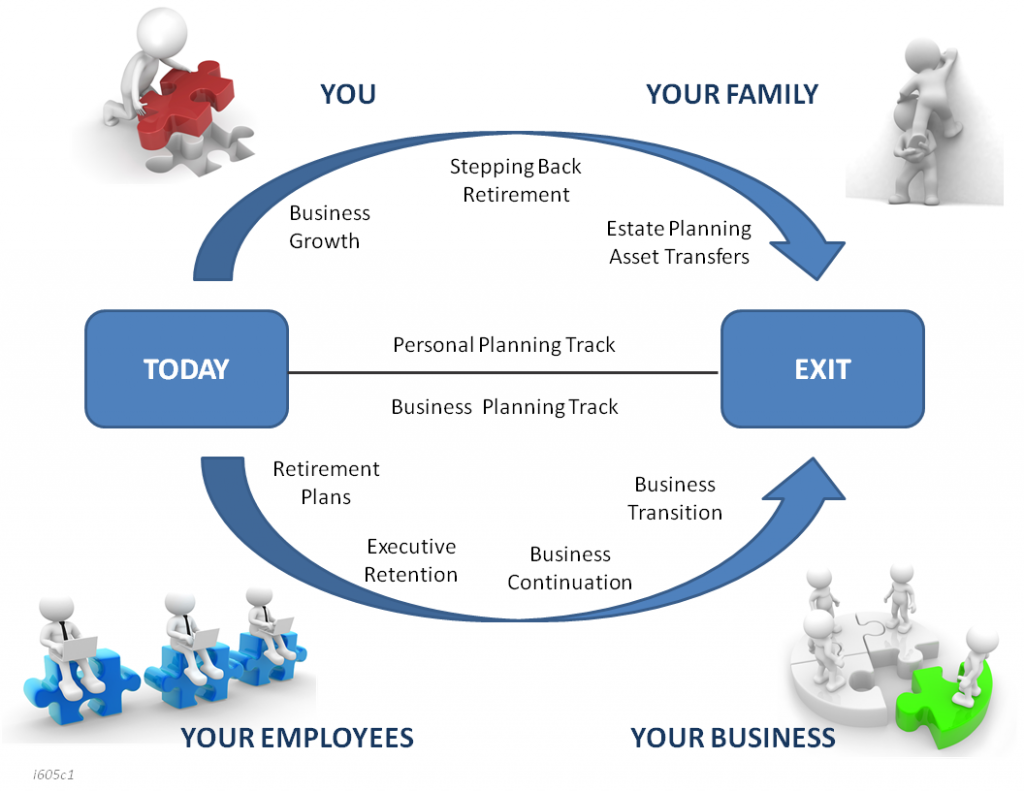

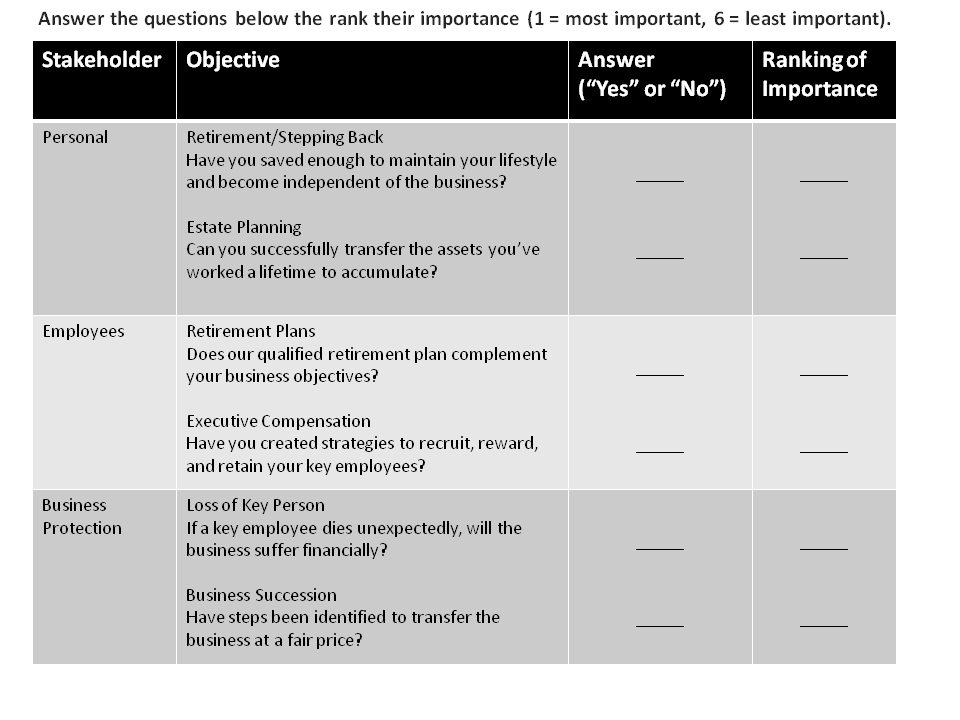

Business owners navigate two tracks instead of one: Personal and business; and the integration of these two tracks in a business owner’s planning are critical to the business owner’s ultimate success.

What are YOUR PRIORITIES?

Personal: Strategies addressing personal concerns:

Retirement/Stepping back

Successful business owners often find 401(k) and similar plans simply aren’t enough – too restrictive – and seek solutions that will provide them with the retirement income they desire without the contribution limits and  administrative headaches they want to avoid.

administrative headaches they want to avoid.

Your retirement strategy should reflect your vision for retirement: will you retire completely, or simply step back from actively managing your business?

By limiting the amount of taxes you pay in retirement, the less likely future tax law changes will impact your planning and the more comfortable your retirement will likely be. The added benefit, of course, is the I.R.S. has less chance of becoming an heir. More on business owner retirement planning.

Estate planning – Transferring assets

Estate planning – Transferring assets

Traditional estate planning focuses on what happens to assets at a business owner’s death. What many don’t realize is that estate planning also provides the opportunity to focus on assets while the business owner is alive.

A business-owner centered estate plan can maximize how you can enjoy life today and in retirement, and also maximize the assets you pass on to your family.

Strategies addressing business concerns:

Executive retention – Keeping Key People

Key employees make critical contributions to a company’s profitability. Selective executive compensation benefits reward those employees most responsible for company growth and allow key employees to share in business accomplishments. Often business owners use supplemental retirement plans and strategic compensation designs to create “Golden Handcuffs”, which can provide a strong incentive for one or more key people to remain with the business long-term, rather than accept an attractive offer from a competitor. The type of design chosen depends upon the business’ unique characteristics. More on executive retention here.

Key person protection

The death of a key employee could cause serious problems for a business, such as lost sales, lower earnings and loss of intellectual capital. It could even affect supplier and banking relationships.

The cost of hiring and training a replacement could negatively impact the business. Successfully dealing with issues like this require a strategy to help cover those costs and to help the business continue to operate smoothly after losing a key employee. More on business continuity.

Business Continuation & Succession

Business Continuation & Succession

A business succession strategy is a key to a company’s success and survival. Having a ‘ready-made’ buyer in-place with secured funding can solve a lot of problems BEFORE they occur. Strategies such as buy-sell arrangements can successfully transfer a business interest on the business owners’ terms. The key is advance planning and a valuation everyone can agree on.

An informal business valuation can avoid the cost of a formal appraisal, yet provide the means for establishing value when the time for transfer arrives. More on business succession

See IFG’s menu of business services.

How to Begin

The first step is an introductory phone call. You can arrange a call with me at a time that’s convenient for you by simply using our convenient scheduler.

I hope we have a chance to talk and maybe meet. I look forward to helping you reach your goals as your unofficial CFO.

Jim

Areas of expertise include:

- Non-qualified deferred compensation plans including Supplemental Executive Retirement Plans (SERPs)

- Individually-owned supplemental savings and benefits arrangement

- Corporate-owned life insurance (COLI) informal funding arrangements

- Corporate-sponsored annuity options

- Executive bonus programs

- Life insurance plans (including; various forms of split-dollar, carve-outs, etc.)