Business owners must not only wear many hats, often they are:

Business owners must not only wear many hats, often they are:

- the active managers of the business

- heavily invested in the business

- running a privately-held business that has no secondary market for the sale of ownership interests

- relying on a small number of important key accounts and suppliers

- relying on a single ongoing source of business credit that is vital to continuing business operations

- limited in the resources that are available to provide employee benefits

While many who are not business owners often fail to do any formal advance planning before actually approaching retirement, successful business owners are usually comfortable with the planning process as an integral component of their business operations.

Integrating business and personal planning, however, is often overlooked. For example, how does a business expenditure impact the value of the business and how will that impact the owner’s retirement plans, access to credit and financing, or the valuation of the business for a future sale?

A couple of tools you might find helpful in beginning your planning are:

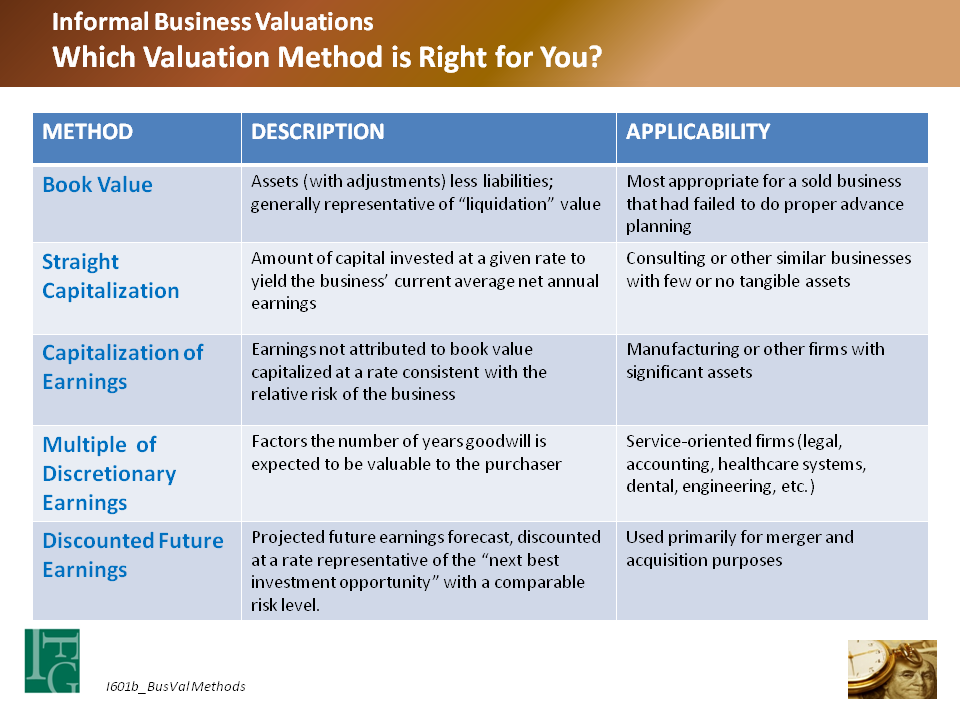

Knowing the value of your business can be quite helpful and an informal valuation need not be expensive. There are a number of methods available:

You might check out our short report, What’s Your Business Worth? You can also obtain a sample valuation report by clicking below.

Click Here to get your Sample Business Valuation Report

If you’d like to schedule an introductory call with me, you can do that here.