A Long Life Is Wonderful When You Can Enjoy It!

Jim Lorenzen, CFP®, AIF® We know we’re living longer; a long life can be wonderful… and some of us get to live better, too. I

Jim Lorenzen, CFP®, AIF® We know we’re living longer; a long life can be wonderful… and some of us get to live better, too. I

Jim Lorenzen, CFP®, AIF® Family business owners face wealth evaporation daily. It’s like glaucoma. You can’t tell it’s happening on a daily basis, but the

Jim Lorenzen, CFP®, AIF® Managing retirement income has never been easy. Those who retired in the early 1970s saw interest rates rise dramatically, then fall

Jim Lorenzen, CFP®, AIF® Business valuation matters! And, not just when you plan to sell. Few business owners realize that valuation ‘what-if’s’ can help determine

Jim Lorenzen, CFP®, AIF® When you receive business sale proceeds, you’ll likely pay a capital gains tax; but, that may not be the end

Jim Lorenzen, CFP®, AIF® 1954 1986 2017 What do those years have in common? If you guessed those were the years of major tax reform,

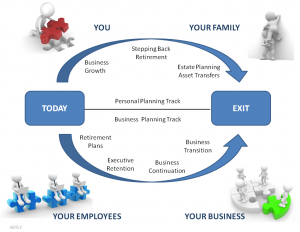

Jim Lorenzen, CFP®, AIF® Business owners spend long hours for many years trying to build their dream. For many, their business represents 70%, 80%, even

Jim Lorenzen, CFP®, AIF® First I want to point out that this post is really courtesy of Senior Deputy Becky Purnell of the Moorpark Police

Jim Lorenzen, CFP®, AIF® People often think investment strategies for retirement security involve a either/or choices, i.e, risky stocks or savings as a zero-sum choice,

Jim Lorenzen, CFP®, AIF® An income for life – a lifetime retirement income strategy is whatmost people want – but are they willing to do

Congratulations—you’ve built up a healthy retirement nest egg, maybe even a couple million bucks in a traditional IRA. Cue the applause! No worry about tax traps now! But as you reach retirement and start thinking about how to spend it (or pass it on), Uncle Sam is waiting with a few surprise moves that could mess with your plans. These are the tax traps.

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.