Big Changes in Social Security Claiming

Jim Lorenzen, CFP®, AIF® The Bipartisan Budget Act of 2015, passed by Congress and signed into law by President Obama on October 30, 2015, will

Jim Lorenzen, CFP®, AIF® The Bipartisan Budget Act of 2015, passed by Congress and signed into law by President Obama on October 30, 2015, will

Jim Lorenzen, CFP®, AIF® I think many, if not most, professional advisors would agree that even 99% of”the affluent” make the same mistakes made by

Jim Lorenzen, CFP®, AIF® Is your income common or uncommon? Most of us think our income is pretty normal, according to most of the studies

Jim Lorenzen, CFP®, AIF® While historic inflation rates average a bit over 4% and many people doing their own calculations may be using figures in

Jim Lorenzen, CFP®, AIF® I can speak from personal experience on this one. I’ve been a business owner for thirty-seven years, owning seven different businesses

Jim Lorenzen, CFP®, AIF® Don’t believe beautiful illustrations. They’re based on assumptions that can change. Unless you know the probability of success in advance –

Jim Lorenzen, CFP®, AIF® Sound familiar? If so, it’s because you saw all those television commercials selling safety to a frightened public. After all, all

What to do with your money in an employer-sponsored retirement plan, such as a 401(k) plan? Since these funds were originally intended to help provide

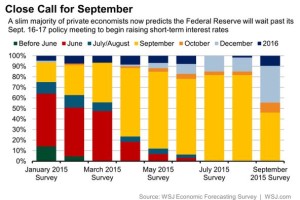

A slim majority of economists don’t believe they will. We’ll soon see if these ‘experts’ are right.

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.