7% Return? From the U.S. Treasury?

Yes, Virginia, Series I bonds sold from November 2021 through April 2022 earn interest at 7.12%. Oops.

Yes, Virginia, Series I bonds sold from November 2021 through April 2022 earn interest at 7.12%. Oops.

Remember when we heard the SECURE Act eliminated the stretch IRA for most all non-spouse beneficiaries?

There are many possible tax strategies available. The question, of course, is which, if any, are appropriate for you.

Jim Lorenzen, CFP®, AIF® You’re probably wondering, “What does the electoral college debate have to do with Thanksgiving? Nothing. It maybe has more to do

Jim Lorenzen, CFP®, AIF® “If you think investing is fun, you’re doing something wrong.” – Warren Buffett I’ll never forget visiting with a nice couple

Jim Lorenzen, CFP®, AIF® Virtually all insurance companies will be using the newer 2012 mortality tables in 2016. Why is that important? The answer is

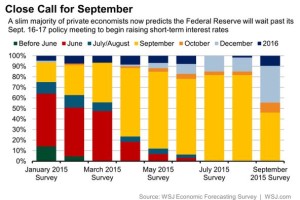

A slim majority of economists don’t believe they will. We’ll soon see if these ‘experts’ are right.

Rising interest rates can have an effect on bond values. After all, if you’re holding a bond paying 2% and interest rates for comparable bonds

Jim Lorenzen, CFP®, AIF® Steven Elwell, a CFP® practitioner in Amherst, NY recently wrote a nice piece for NerdWallet on this subject. In his piece,

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.