Tag: social security

Social Security Claiming Mistakes Can Be Expensive.

Social Security claiming mistakes can result in more than just lost income; you might end-up paying thousands in extra taxes later!

Social Security Claiming Mistakes Mean Retirees Set To Lose $3.4 Trillion in Retirement Income.

Over half of all Americans expect to live a comfortable retirement and only one third think Social Security will be important to them.

Social Security Report Indicates Benefit Cuts May Be On The Way.

The Social Security Board of Trustees released its annual report on the long-term financial status of the Social Security Trust Funds.

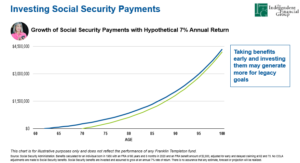

Should You ALWAYS Wait to Claim Social Security Benefits?

There may be times when you might decide it’s worth claiming your Social Security benefits early!

Women and Social Security Land Mines

Bad decisions can create time bombs, and few decisions can be as disastrous as those that result from the mistakes many women make when it comes to claiming Social Security benefits. This is particularly true for widows, divorced spouses, and stay-at-home parents.

How Social Security and Pensions Might Impact How You Arrange Your Nest-Egg.

If you’re receiving Social Security, Pension, or other guaranteed income, you may want to rethink how your nest-egg is arranged for long-term inflation risk.