Facing Retirement Account Rollover Decisions?

Believe it or not, you’ll have a number of options available to you – and it pays to do your homework before making decisions that could be irrevocable – and costly.

Believe it or not, you’ll have a number of options available to you – and it pays to do your homework before making decisions that could be irrevocable – and costly.

At retirement, some people receive a check from their employer for their 401(k) balance and write a check for deposit into their IRA before the 60-day deadline, just like they were told, to avoid any problems with the IRS. They’ve met the deadline. The money is now in their IRA. They’re clear and the rollover is complete…. or is it?

Here’s what people get wrong when making rollover decisions.

Rollover advice isn’t always straightforward – it’s often conflicted. There are issues you should address before you act.

Jim Lorenzen, CFP®, AIF® Getting ready to retire? Planning to roll your 401(k) into your own IRA? It will pay to do your homework first.

Jim Lorenzen, CFP®, AIF® Getting ready to pull the retirement cord? In a previouspost, I had talked about pension options – worth reviewing if that’s

Jim Lorenzen, CFP®, AIF® According to Cerulli Associates, rollovers from 401(k)s and other retirement plans will cause IRA assets to reach $12 trillion by 2020,

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

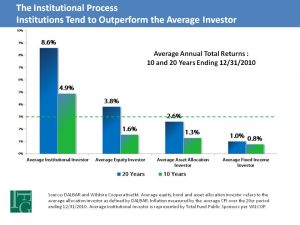

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.