SECURE Act 2.0: RMD Age Hikes Coming?

RMD age hikes may not be the blessing you think. The question just might be who is more secure? Retirees or future government spending?

RMD age hikes may not be the blessing you think. The question just might be who is more secure? Retirees or future government spending?

Retirement decisions can be momentous. Which year you would have remembered would depend on if you retired back then… and which year!

Congress labeled it the SECURE Act, because it’s a better sell to the public. But, what Uncle Sam really wanted to do was make their spending programs more secure – hence, securing reelection.

Looking for retirement security?

Government spending has been out of control for decades and Congress needs to raise revenue. So, they passed The SECURE (Setting Every Community Up for Retirement Enhancement) Act in December 2019. It may secure the government’s future; but, one provision may make your heir’s retirement a little less secure.

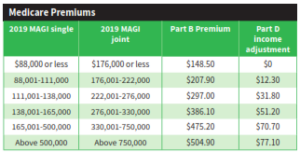

Tax traps are waiting. Did you it’s possible to be smack in the middle of the 22% tax bracket, yet taking an additional $1,000 in income could make that additional money taxable at 40%? It can happen to some taxpayers. In fact, there are other pitfalls many aren’t aware of, as well.

Remember 1966? What if you retired then? Would it have made a difference if you retired in 1967 instead? Can you time retirement? If not, how do you reduce your risk when there’s no time to rebuild all over again?

Retirement planning was much easier during working years than the challenge of managing after retirement. During the working years it’s relatively simple: just keep stashing money into your retirement plan and let the markets, over decades, do the rest!

There may be times when a Roth conversion may be advantageous; but there are others when it may not be your best move.

Longevity risk is real. Accumulating assets for retirement was a lot easier than managing retirement income. Now you practically have to be an actuary to make sure your money doesn’t run out before you do!

Longevity risk is real. Accumulating assets for retirement was a lot easier than managing retirement income. Now you practically have to be an actuary to make sure your money doesn’t run out before you do!

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

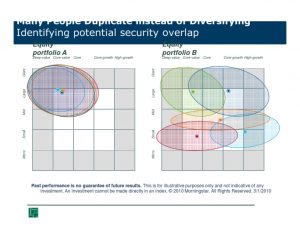

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.