Annuity Income May Contain a Hidden Surprise

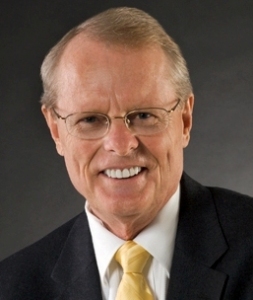

Jim Lorenzen, CFP®, AIF® Annuity income may feel secure; but, is it really? Once you realize that money is worth only what it can purchase,

Jim Lorenzen, CFP®, AIF® Annuity income may feel secure; but, is it really? Once you realize that money is worth only what it can purchase,

Jim Lorenzen, CFP®, AIF® It isn’t uncommon for people to buy things they don’t need; and when it comes to annuities, it’s often no different,

Jim Lorenzen, CFP®, AIF® Think interest rates may be headed up in the future? Looking for a “safe” way to produce a rising income if

Jim Lorenzen, CFP®, AIF® Wouldn’t it be comforting to know you’re retirement is assured? An income you can’t outlive does have appeal. People who retire

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.

What most people don’t realize: There are some important details about how and when these delayed credits are actually added to your benefit.