Life Insurance

THE MARKET IS AT ALL-TIME HIGHS! Corrections, however, are a fact of life.

For workers in their 40s and 50s facing massive government debt and retirement 15-20 years off, it’s worth asking: Is it time to (Dump) THE

For workers in their 40s and 50s facing massive government debt and retirement 15-20 years off, it’s worth asking: Is it time to (Dump) THE

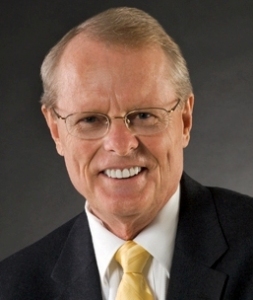

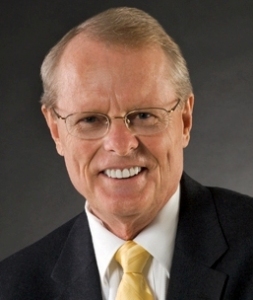

Jim Lorenzen, CFP®, AIF® Getting ready to retire? Planning to roll your 401(k) into your own IRA? It will pay to do your homework first.

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.