Did You Know the Government Subsidizes Market Losses in Traditional IRA and 401K accounts?

True! Market losses aren’t all yours. The IRS subsidizes part of them.

True! Market losses aren’t all yours. The IRS subsidizes part of them.

For some people, planning for retirement can feel like trying to eat an elephant; but, it doesn’t have to be that way. Before making big decisions, it’s always important to get the ducks lined-up first.

Have you tried to call Social Security lately? If so, this won’t come as much of a surprise – customer service is all but non-existent.

RMD age hikes may not be the blessing you think. The question just might be who is more secure? Retirees or future government spending?

Managing inherited money isn’t as simple as depositing the check and picking some sure-fire investments.

Retirement decisions can be momentous. Which year you would have remembered would depend on if you retired back then… and which year!

No investment strategy is without some kind of risk; but, I think this comes close. Take a look:

The annual Social Security trustees’ report is to advise Congress on the financial condition of the Social Security system over the next 75 years. If they project that 100% of benefits will be paid, it’s said to be in balance and no action will be needed. If they project a shortfall, they call on Congress to fix the problem by either raising taxes, cutting benefits, or some combination of the two.

Congress labeled it the SECURE Act, because it’s a better sell to the public. But, what Uncle Sam really wanted to do was make their spending programs more secure – hence, securing reelection.

Tax Planning doesn’t stop at retirement. In fact, tax planning is important for optimizing retirement income – and it changes during all four stages of retirement.

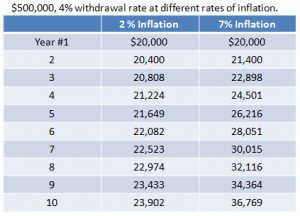

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

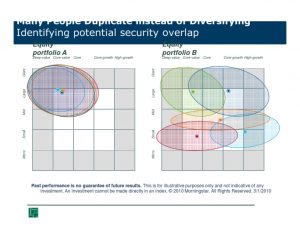

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.