What’s New for Social Security in 2023?

There have been some changes to Social Security this year.

There have been some changes to Social Security this year.

At retirement, some people receive a check from their employer for their 401(k) balance and write a check for deposit into their IRA before the 60-day deadline, just like they were told, to avoid any problems with the IRS. They’ve met the deadline. The money is now in their IRA. They’re clear and the rollover is complete…. or is it?

Here’s what people get wrong when making rollover decisions.

Too many seniors still take the Social Security claiming decision too lightly – it’s a mistake that can cost them tens, if not hundreds, of thousands of dollars of retirement income during their lifetimes. And, often, the decision is made based on false bias or assumptions rather than a solid planning strategy.

The SECURE Act 2.0 may do a lot to help secure Uncle Sam, but I’m not so sure about the rest of us.

No, we’re not training your dog. But, if you’re nearing retirement, you know exactly what a rollover is – and you know it’s a big decision.

After passage of the SECURE Act of 2019, non-spouse IRA beneficiaries are now required to liquidate their inherited IRAs by the end of the 10th year. Often, that means they’ll be withdrawing taxable income from the inherited IRAs during their peak earning years – great gift for Uncle Sam, but not so good for the kids.

Mistakes can be costly – and may be permanent!

The value of ESG – or even what it is – hasn’t been defined. So, it depends on who you ask, how the law is interpreted, and apparently, who’s doing the packaging. Oh, yes, it also depends on how you quantify it.

How about an asset class that doesn’t have the risks of stocks or bonds? One that can provide stability and peace of mind.

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

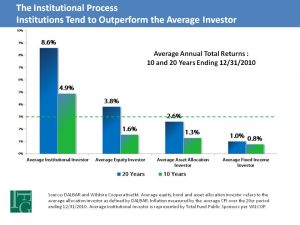

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.