Facing Retirement Account Rollover Decisions?

Believe it or not, you’ll have a number of options available to you – and it pays to do your homework before making decisions that could be irrevocable – and costly.

Believe it or not, you’ll have a number of options available to you – and it pays to do your homework before making decisions that could be irrevocable – and costly.

Believe it or not, investing during working years was the easy part. Just keep accumulating! Even better, the money you put aside wasn’t taxable. Such a deal! Tax-delayed doesn’t mean tax-free however.

It depends on how much you have invested in the market. If you’re a conservative retiree, should you care?

Inflation deflates purchasing power. We all know that. After all, money is worth only what it buys.

So, you want to dive into the stock market without losing your sanity or, more importantly, your hard-earned cash? Here’s a strategy that’s not exactly ‘rocket science’ – Here’s a risk-free investment strategy that’s a ‘diet version’ of a financial plan. It surely doesn’t cover all the bases, but it’s sure to spice up your next dinner party conversation.

Rollercoasters are fun – at the amusement park. Not so much in your retirement account. And that’s where bad financial behavior gets costly.

You want to begin planning your future life, but aren’t sure how. You want help but don’t know how to get stareted. Sound familiar? It should.

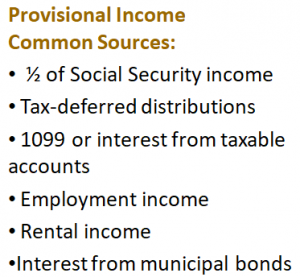

There are a lot of myths surrounding Roth conversions and this one might rank near the top, and you should know why. It’s important to have some historical perspective.

But Congress Could Provide the Wild Card. Roth accounts can be attractive, especially when viewed through the lens of our national debt and the possibility (probability?) of higher taxes in the future to fund that debt.

Older annuities have grown – and so have their expenses. They may be worth a review.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.

What most people don’t realize: There are some important details about how and when these delayed credits are actually added to your benefit.