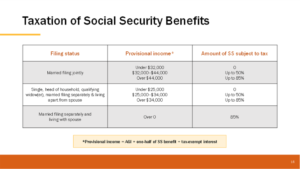

No Tax on Social Security Benefits?

We all love free money; and no taxes on Social Security sounds good! Hey, Social Security benefits weren’t taxed for many years!

We all love free money; and no taxes on Social Security sounds good! Hey, Social Security benefits weren’t taxed for many years!

RMD age hikes may not be the blessing you think. The question just might be who is more secure? Retirees or future government spending?

I don’t know anyone, certified financial planner professionals included, who is a fan of surrender charges; but, economically they are a fact of life for many products simply to make the offering available and viable for the investment or financial product provider.

Required minimum distributions (RMDs) have been eliminated for 2020 due to the COVID-19 pandemic; but, you just might want to consider taking a distribution anyway. Why?

Most people work long hours for 30+ years trying to build wealth for themselves and their families. These three tips can make it a little easier.

Few understand the power of the investment allocation model, even in – especially in – times of crisis; but the power can be great when tied to a long-range financial plan.

If you’re receiving Social Security, Pension, or other guaranteed income, you may want to rethink how your nest-egg is arranged for long-term inflation risk.

Increased debt, the worry of a debt spiral, low yields, and future taxes – all make a solid plan more important than ever. Unfortunately, too many put it off until the’re “confident’, but they never get there.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.