Business Owners Face Potential Tax Law Changes

Jim Lorenzen, CFP®, AIF® 1954 1986 2017 What do those years have in common? If you guessed those were the years of major tax reform,

Jim Lorenzen, CFP®, AIF® 1954 1986 2017 What do those years have in common? If you guessed those were the years of major tax reform,

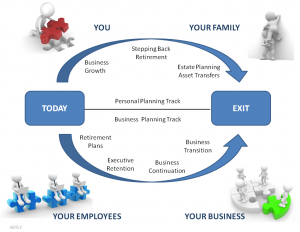

Jim Lorenzen, CFP®, AIF® Business owners spend long hours for many years trying to build their dream. For many, their business represents 70%, 80%, even

Jim Lorenzen, CFP®, AIF® Successful business owners know they’re successful because of their people. Within that group there’s usually one or two key people that

Jim Lorenzen, CFP®, AIF® No, that’s no my picture – I wish I were that young and good looking; but he does look like a

Jim Lorenzen, CFP®, AIF® Executive Bonus plans are a little different from Non-Qualified Deferred Compensation Plans (NQDC), which we talked about in another short paper.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.