2022 Decisions Can Affect 2024 Taxes for Some!

Expecting a big capital gains or other tax event this year? It might mean an unexpected tax surprise that can affect your Medicare premiums two years from now!

Expecting a big capital gains or other tax event this year? It might mean an unexpected tax surprise that can affect your Medicare premiums two years from now!

Tax traps are waiting. Did you it’s possible to be smack in the middle of the 22% tax bracket, yet taking an additional $1,000 in income could make that additional money taxable at 40%? It can happen to some taxpayers. In fact, there are other pitfalls many aren’t aware of, as well.

Have you checked your Social Security statement on the SSA’s website? You should; there’s a lot of good information there!

If you’re a baby boomer, you may want to begin your Social Security planning early – and it’s especially true when it comes to claiming Social Security! Today it’s different from when your parents filed their claims: they just went down to the Social Security office and put in the paperwork! Today, it’s far more complicated.

Social Security can be confusing; even the hard-working people working in Social Security offices don’t always get it right. Here are the two questions advisors often get asked.

Social Security claiming mistakes can result in more than just lost income; you might end-up paying thousands in extra taxes later!

Over half of all Americans expect to live a comfortable retirement and only one third think Social Security will be important to them.

The Social Security Board of Trustees released its annual report on the long-term financial status of the Social Security Trust Funds.

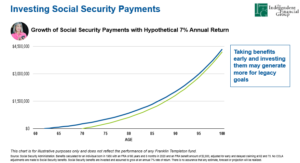

There may be times when you might decide it’s worth claiming your Social Security benefits early!

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.