Thinking About a Rollover?

No, we’re not training your dog. But, if you’re nearing retirement, you know exactly what a rollover is – and you know it’s a big decision.

No, we’re not training your dog. But, if you’re nearing retirement, you know exactly what a rollover is – and you know it’s a big decision.

After passage of the SECURE Act of 2019, non-spouse IRA beneficiaries are now required to liquidate their inherited IRAs by the end of the 10th year. Often, that means they’ll be withdrawing taxable income from the inherited IRAs during their peak earning years – great gift for Uncle Sam, but not so good for the kids.

Mistakes can be costly – and may be permanent!

The value of ESG – or even what it is – hasn’t been defined. So, it depends on who you ask, how the law is interpreted, and apparently, who’s doing the packaging. Oh, yes, it also depends on how you quantify it.

How about an asset class that doesn’t have the risks of stocks or bonds? One that can provide stability and peace of mind.

True! Market losses aren’t all yours. The IRS subsidizes part of them.

For some people, planning for retirement can feel like trying to eat an elephant; but, it doesn’t have to be that way. Before making big decisions, it’s always important to get the ducks lined-up first.

Have you tried to call Social Security lately? If so, this won’t come as much of a surprise – customer service is all but non-existent.

RMD age hikes may not be the blessing you think. The question just might be who is more secure? Retirees or future government spending?

Retirement decisions can be momentous. Which year you would have remembered would depend on if you retired back then… and which year!

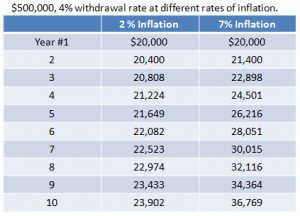

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.