2022 Decisions Can Affect 2024 Taxes for Some!

Expecting a big capital gains or other tax event this year? It might mean an unexpected tax surprise that can affect your Medicare premiums two years from now!

Expecting a big capital gains or other tax event this year? It might mean an unexpected tax surprise that can affect your Medicare premiums two years from now!

Tax traps are waiting. Did you it’s possible to be smack in the middle of the 22% tax bracket, yet taking an additional $1,000 in income could make that additional money taxable at 40%? It can happen to some taxpayers. In fact, there are other pitfalls many aren’t aware of, as well.

Remember 1966? What if you retired then? Would it have made a difference if you retired in 1967 instead? Can you time retirement? If not, how do you reduce your risk when there’s no time to rebuild all over again?

Retirement planning was much easier during working years than the challenge of managing after retirement. During the working years it’s relatively simple: just keep stashing money into your retirement plan and let the markets, over decades, do the rest!

We’ve all been conditioned to believe the well-known 529 plan is the “designated” college savings vehicle – people tend to think of it automatically when planning.

Social Security can be confusing; even the hard-working people working in Social Security offices don’t always get it right. Here are the two questions advisors often get asked.

I wish I could take credit for this list, but I can’t. This is from the Society of Actuaries who outlined these unexpected or shocking expenses in its 2015 Risks and Process of Retirement Survey. I doubt it’s changed much since. Here they’re ranked by the likelihood of it happening.

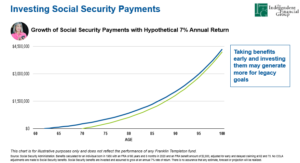

There may be times when you might decide it’s worth claiming your Social Security benefits early!

Bad decisions can create time bombs, and few decisions can be as disastrous as those that result from the mistakes many women make when it comes to claiming Social Security benefits. This is particularly true for widows, divorced spouses, and stay-at-home parents.

Retirement Income Planning Gains Importance.

Congratulations—you’ve built up a healthy retirement nest egg, maybe even a couple million bucks in a traditional IRA. Cue the applause! No worry about tax traps now! But as you reach retirement and start thinking about how to spend it (or pass it on), Uncle Sam is waiting with a few surprise moves that could mess with your plans. These are the tax traps.

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.