Smart Financial Planning Goes Beyond Estate Planning

Money matters don’t happen in a vacuum—what you do with your finances can impact your entire family, from your children to your aging parents. Even if your bank accounts remain separate, it makes sense for you and your family to approach estate planning as a collaborative effort across generations. By aligning financial goals and responsibilities, you can ensure that your family’s future is secure, and that the wealth you’ve built is passed down smoothly to the next generation.

Most people focus on their own needs when working with an advisor—issues like retirement savings, investments, or budgeting for major purchases. For baby boomers, estate planning and Social Security are top priorities, while younger generations are focused on saving for their first home or paying off student loans. However, taking a step back to consider the bigger picture can help families make smarter financial decisions together. By incorporating estate planning into your family’s broader financial strategy, everyone—across generations—can align their goals for a more secure future.

Maybe We Should Think About Family Finances as a Whole?

Families often share financial responsibilities, whether it’s grandparents helping with college tuition, parents caring for aging relatives, or adult children moving back home. Our lives are financially intertwined, making estate planning a crucial conversation for families. Having open discussions about money not only makes sense but can also help avoid surprises and ensure everyone is on the same page. Even if each family member’s finances remain separate, coordinating financial plans can lead to smarter choices and fewer headaches, especially when it comes to managing retirement savings, healthcare costs, and passing down wealth across generations.

Key Topics to Consider

Bringing Family into Financial Discussions

At your next financial check-in, think about these questions:

- Are your kids or grandkids getting ready for college?

- Are your adult children looking to buy a home?

- Do your parents need help with caregiving or medical expenses?

A financial checklist can also help you cover all the bases.

Keeping Up with Family Changes

Life changes fast—marriages, divorces, new babies, adoptions, or even kids moving back home can all have financial implications. Keeping track of these changes – and planning ahead – can prevent a lot of financial stress down the road. And, don’t forget aging parents’ financial well-being. An ounce of prevention (you know the rest) can help avoid last-minute decisions in times of crisis.

Aligning Financial Goals Across Generations

Different family members often have different goals—some want to buy a home, others may be starting a business, and some are focused on retirement. Even if your finances aren’t combined, discussing these goals openly can be helpful. Do you have strategies to support different family members in reaching their financial milestones?

Planning for Business Succession

Do you own a business and want to pass it down to your kids? What’s the plan. It needs to be more than ‘they’ll just take over’. You’ll need an income for retirement while they’ll need an income to live! Will it support both? What if they don’t want the business? Good advice: start planning early. A well-structured exit or succession plan ensures a smooth transition while also handling any tax or legal concerns that might come up.

Career and Work Planning

Still working? Helping to provide financial support for a younger generation? Delaying retirement? Having career conversations with younger family members can also help guide them toward financial independence.

Health and Medical Costs

You know about this one. Healthcare expenses can be a major financial strain. Do you have a formal written plan that integrates these issues into your retirement?

Managing Investments and Wealth

Financial planning isn’t just about saving money—it’s about smart investing, minimizing taxes, and managing cash flow. There’s an old saying that people are seldom hurt by their investments; they’re usually hurt by their behavior. It’s also important that both spouses or partners are on the same page and stay informed about financial matters in case of unexpected life changes.

The only thing that surprises me is that we continue to be surprised when surprise happens. – Donald Rumsfeld, former Secretary of Defense.

Estate Planning and Passing on Wealth

Estate planning is more than simply making a will—it’s about ensuring your family is financially prepared for the future. Beyond just passing down assets, it’s important to prepare beneficiaries to manage their inheritance wisely. Discussions now can prevent confusion and conflict later on.

Retirement Planning for the Whole Family

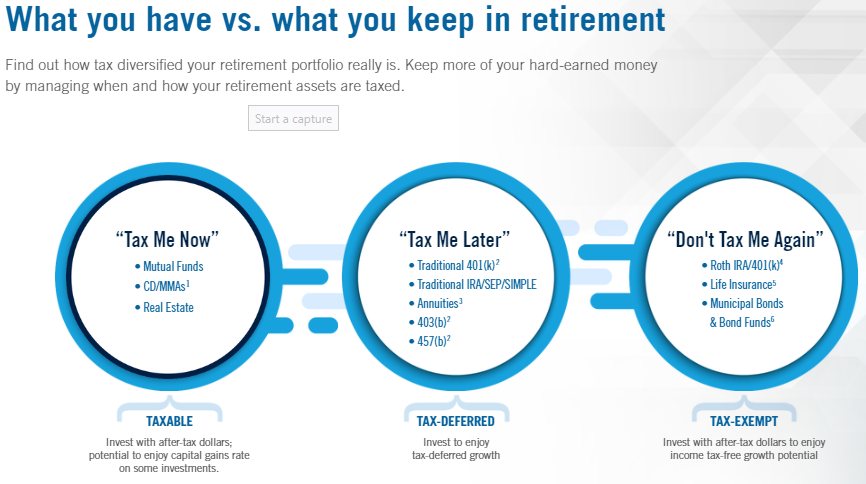

Planning for your own retirement is crucial, but it’s equally important to consider how your retirement planning affects your family. With estate planning in Simi Valley, ensure that your retirement accounts are set up properly and that your loved ones understand key aspects like required minimum distributions (RMDs) and inherited IRAs, including the tax consequences of your financial decisions. By addressing these factors, you can help your family avoid unexpected tax burdens and ensure a smooth transition of wealth. If the wealthiest families receive financial guidance to navigate these complexities, it only makes sense for the rest of us to take the same approach with estate planning.

Preparing for Future Financial Changes

Change is the only constant, and many changes can be anticipated. As part of estate planning in Simi Valley, it’s important to think ahead—what big changes might happen in the next five years? Does your family have enough savings to handle unexpected expenses without dipping into long-term investments? How do you know? Have your assumptions been tested? Ensuring everyone’s financial stability through proper estate planning can prevent last-minute financial scrambles and provide peace of mind for the future.

Why a Multi-Generational Approach Makes Sense

Money decisions have a rippling effect. They don’t just affect one person—consequences ripple across the family. Looking at financial planning as a shared effort can help ensure everyone is on solid ground, from young adults just starting out to retirees enjoying their golden years.

What are your priorities? You can use this form or you can tell me here!

If I can help, the place to begin is on the Getting Started page.

Jim